Plan Sponsor Update – 2024 Retirement & Employee Benefit Plan Limits

The Internal Revenue Service released 2024 cost-of-living adjustments for dollar limitations on benefits and contributions. These include employer-sponsored retirement and welfare plans and may affect how plan sponsors administer their plans in the coming year.

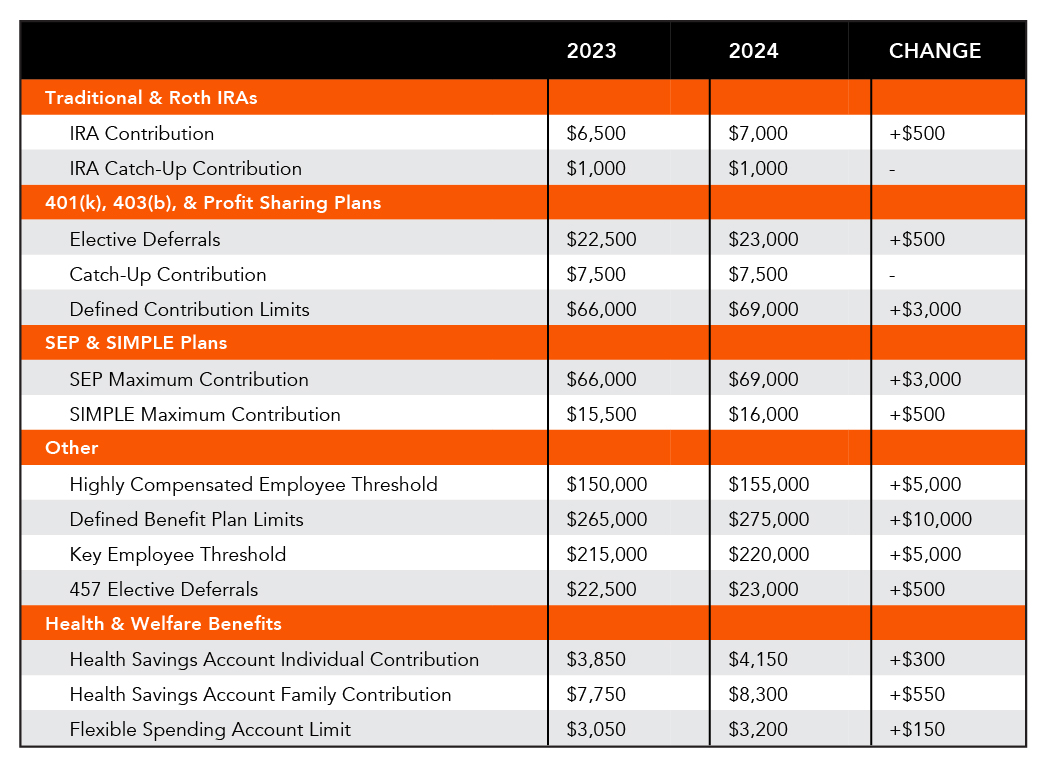

2024 Key Increases

- Traditional and Roth IRA contribution limits

- Salary deferral limits for 401(k), 403(b) and 457 plans

- SEP and SIMPLE plan contribution limits

- Highly Compensated Employee and Key Employee thresholds

- FSA limit, as well as previously announced HSA contribution limits

The table below compares dollar limits on retirement accounts and employee benefit programs for 2023 and 2024:

Click to view and download our 2024 Retirement Plan & Benefit Limits chart. If you have questions about this information or how it may apply to your plan, please contact Midland Retirement Plan Services at (815) 231-2816 or retirement@midlandsb.com.