Maximize on Real Estate

We offer competitive interest rates that are designed to meet your investment goals while keeping your costs manageable.

Choose from a range of loan terms to suit your investment strategy. Whether you're aiming for short-term gains or long-term stability, we have options that fit your situation.

Tailor your loan amount to match the investment property's value and your financial capacity, helping you optimize your investment potential.

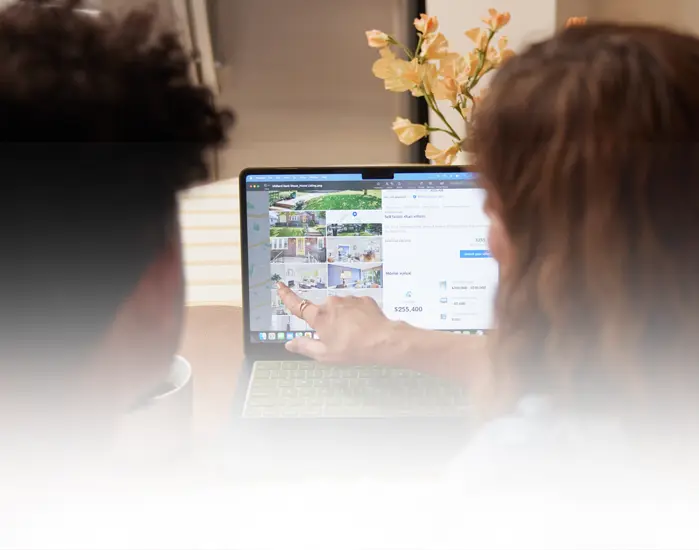

We understand that time is of the essence in the real estate market. Our efficient online application process aims to get you the financing you need as quickly as possible.

Investing in rental properties is a smart way to grow your wealth. By purchasing a property to rent out, you can earn more than the monthly expenses, making it a profitable real estate investment.

Whether you own several rental homes, or you are interested in real estate investing for beginners, our experienced loan officers are here to guide you through the loan application process, offering insights and advice to help you make informed decisions.

If you plan to reside in part of the property and rent out other units or sections to tenants, this arrangement allows you to generate rental income while also benefiting from the convenience of living on the property. You can potentially lower mortgage rates compared to non-owner-occupied investment properties. As an owner-occupier, you may be able to take advantage of these investment property loan options as well as others:

A non-owner-occupied mortgage is an investment property mortgage, or rental mortgage, that is tailored for borrowers who have no plans to reside in the property themselves.

Single Family Unit Property

With a single-family unit, you have only one set of tenants, which can mean fewer maintenance concerns and potentially lower vacancy risks. This may be an easier solution for individual investors, especially those who are new to real estate investing.

Multifamily or Multiunit Property (Non-Owner Occupied)

Purchasing properties with multiple units allows you to generate rental income from each unit, potentially increasing overall cash flow compared to single-unit properties.

Our team of dedicated professionals are here to support you.