Checking for Your Brightest Moments

We like to help you keep more of what's yours by including free digital banking, free eStatements, and free bill pay with every new checking account.

Open a qualifying checking account by April 3, and we’ll give you a $25 eGift Card!1

| Feature | Totally Free Checking | 50+ Interest Checking | Direct Interest Checking | High Yield Checking |

|---|---|---|---|---|

| Minimum Opening Balance | $50 | $50 | $50 | $50 |

| Monthly Service Charge | $0 | $0 | $0 | $0 or $10 |

| Minimum Balance to Earn Interest | N/A | $0.01 & up | $0.01 & up | $0.01 - $1,499.99 |

| Balance to Earn Premium Interest | N/A | N/A | N/A | $1,500 & up |

| Free Standard Checks | N/A | 1 Box Annually | N/A | Unlimited Free Checks |

| Key Features & Benefits |

|

|

|

|

| Open Account | Open Account | Open Account | Open Account |

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 |

| Minimum Balance to Earn Interest | N/A |

| Balance to Earn Premium Interest | N/A |

| Free Standard Checks | N/A |

| Key Features & Benefits |

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 |

| Minimum Balance to Earn Interest | $0.01 & up |

| Balance to Earn Premium Interest | N/A |

| Free Standard Checks | N/A |

| Key Features & Benefits |

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 or $10 |

| Minimum Balance to Earn Interest | $0.01 - $1,499.99 |

| Balance to Earn Premium Interest | $1,500 & up |

| Free Standard Checks | Unlimited Free Checks |

| Key Features & Benefits |

|

| Minimum Opening Balance | $50 |

|---|---|

| Monthly Service Charge | $0 |

| Minimum Balance to Earn Interest | $0.01 & up |

| Balance to Earn Premium Interest | N/A |

| Free Standard Checks | 1 Box Annually |

| Key Features & Benefits |

|

I keep saying over and over and over again. Great bank, great people, friendly, easy-to-use website. I wouldn’t bank anywhere else.Maher, Customer for 11 Years

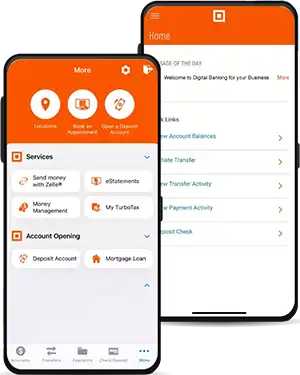

Great convenience. It is easy to pay my monthly bills online. I like the mobile app which makes it easy to check balance, deposit checks, make transfers between accounts, and review withdrawals.Terry, Customer for 28 Years

Banking by app has been a great experience. I am handicapped and unable to get out. Every time I call the office, I get excellent service.John, Customer for 24 Years

What Do You Need to Open a Bank Account?

Whether you're starting your first account or adding a new one, knowing what you need to open a bank account can save you time and hassle. Here's what you need to get started.

What Do You Need to Open a Bank Account?

Whether you're starting your first account or adding a new one, knowing what you need to open a bank account can save you time and hassle. Here's what you need to get started.

Do Checking Accounts Earn Interest?

Did you know checking accounts can help grow your money? Let’s break down how and when you can earn interest from your checking account.

Do Checking Accounts Earn Interest?

Did you know checking accounts can help grow your money? Let’s break down how and when you can earn interest from your checking account.

Our team of dedicated professionals are here to support you.

1 Member FDIC. The minimum balance required to open the account and obtain the bonus is $50. Ask banker for details. Bank rules and regulations apply. Other fees such as non-sufficient funds, overdraft, sustained overdraft fees, etc. may apply. See fee schedule for complete details. This promotion is valid from February 23, 2026 through April 3, 2026 for customers who open a qualifying checking account. Accounts opened between February 23 and March 8, 2026, and between March 15 and April 3, 2026, will receive a $25 eGift card. Accounts opened during the promotional week of March 9–14, 2026, will receive a $100 eGift card. The eGift card will be provided electronically within two business days after account opening. Gift may be reported on a Form 1099-INT or 1099-MISC.