Most Americans give to charity on a regular basis. What many Americans may not realize is that their charitable donations are not receiving the same tax benefits that they once did.

The Tax Cuts and Jobs Act was passed in late 2017 and it significantly increased the size of the standard deduction. As a result, most Americans no longer itemize their tax deductions – in 2020, just 13% of Americans itemized their deductions. This means that for the 87% of taxpayers who take the standard deduction, donations to charity no longer provide a tax benefit.

Considering this fact, taxpayers taking a standard deduction (and even those who itemize!) and who give to charity should consider doing so via a Qualified Charitable Distribution (QCD).

What is a QCD?

A QCD is a direct payment of funds from your Individual Retirement Account (IRA) to a qualifying charity.

What are the requirements of a QCD?

- The IRA owner must be at least 70.5 years old at the time of the donation.

- You CANNOT make QCDs from 401(k), 403(b), and pension plans.

- The distribution must be payable to charity. It cannot first be paid to you, with you then depositing the funds and donating to charity.

- Distributions cannot exceed $100,000 in any given year (per IRA owner).

- Not all charitable organizations are appropriate recipients. You cannot make a QCD to a donor-advised fund, private foundation, or charitable remainder trust.

What are the potential benefits of making a QCD?

- While the amounts paid to charity are NOT individually deductible, they ARE excluded from an IRA owner’s adjusted gross income. This makes this strategy particularly beneficial when an IRA owner must take his/her Required Minimum Distribution (RMD). The RMD is taxable; so by donating some or all of RMD to charity (and thereby excluding that amount from income), it will feel like a tax deduction.

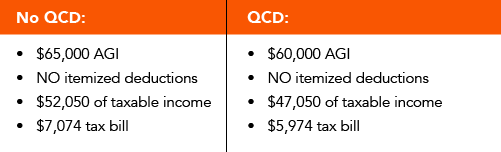

- Consider the following example: Tom Taxpayer, single and 75 years old, owns an IRA and must take $15,000 of RMDs in 2022. His other income is $50,000. He desires to give his church $5,000. Even with this charitable donation, he will not have enough deductions to itemize his deductions. Consequently, he will utilize the $12,950 standard deduction for single persons. Tom can save $1,100 in income taxes simply by making this charitable donation from his IRA rather than writing them a check:

I hope this article has been helpful to you. QCDs are an important tool when planning your retirement withdrawal strategy. If you would like to discuss this further, please do not hesitate to reach out to one of our Midland Wealth Management advisors.