Don’t Wait to Save or Invest

by Stephanie Jacobs, MBA, AFIM®

Senior Wealth Advisor, Midland Wealth Management

I’m Stephanie Jacobs, Senior Wealth Advisor at Midland Wealth Management.

There’s a saying in the investment community, “The best time to invest was yesterday. The second-best time is right now.” What we mean is that the earlier you start to save, the earlier your money will start to grow. This is made possible through the effect of compounding. As long as you leave the earnings in your savings account or reinvest in your investments, the opportunity for growth increases over time. And that is the key – “over time.” The longer you let compounding work, the more likely you are to see positive results.

If you have a savings account, you have a basic idea of how this works already. Money in your account earns interest, which is then added to the money currently in the account. Then next month, when the interest is calculated, it’s done using that new value of the original dollar amount plus the previous month’s interest earned, and so on, for the next month and the following. It’s difficult to appreciate the impact of compounding at the current savings account rates, however, investing can increase the potential of compounding in a big way.

Over time, the stock market always outperforms bonds, gold, and cash.* And yes, we also know that it can decline from time to time, as we’ve seen in the first several months of this year. Investing does carry risk, however, the longer you are invested, the more likely you are to experience positive returns.

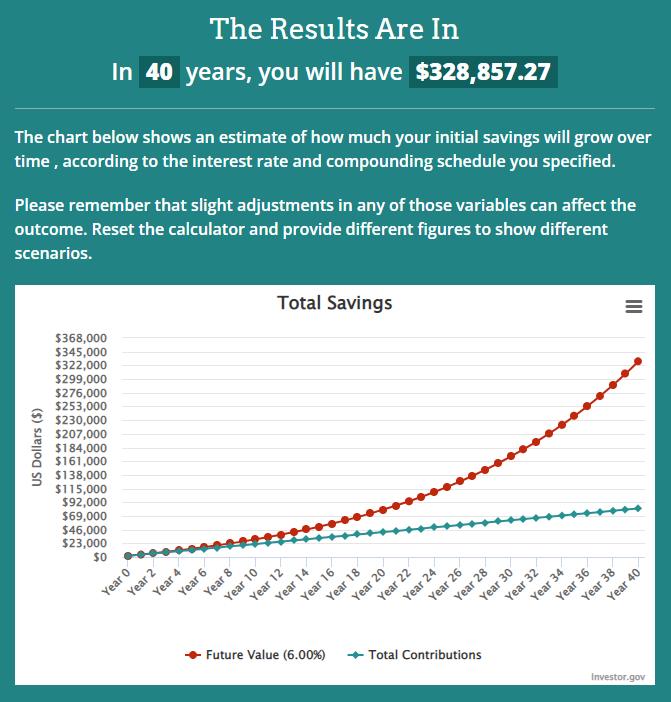

So let’s take a moment to look at an example. Let’s assume a 25-year-old invests $2,000 a year until they reach the age of 65. Their $81,000+ investment would make retirement challenging if it weren’t for compounding returns. A 6% annual return can increase those dollars to over $328,000. Starting to save later in life means less time for compounding. Someone who starts saving at age 40 under the same percentage would only see their investments reach $117,000 by that same age 65.

If you want to get an idea of how long it will take to reach your savings goal, you can visit midlandsb.com/tools-calculators or try the Rule of 72. Take the number 72 and divide it by the estimated rate to get the number of years that it will take to double your investment. You can also reverse this and take 72 by the number of years you have until you reach your goal to estimate the rate of interest you’ll need to save in order to reach it.

So what we’re trying to say is this – if you want to meet your goal of retiring early or buying that vacation home, you need to make saving a habit. It can’t be sporadic, and it should be ongoing. If you’re not sure where to start, try the 50-30-20 rule. 50% of your income needs to go to your needs, 30% to your wants, and 20% to savings. Your future self will be glad you did.

*Per historical stock returns since the Great Depression; see forbes.com/advisor/investing/stock-and-bond-returns/ for more info.