The Resilient U.S. Economy

SUMMARY:

A near-term recession continues to be elusive as the employment market remains healthy and inflation continues to moderate.

OUR PERSPECTIVE:

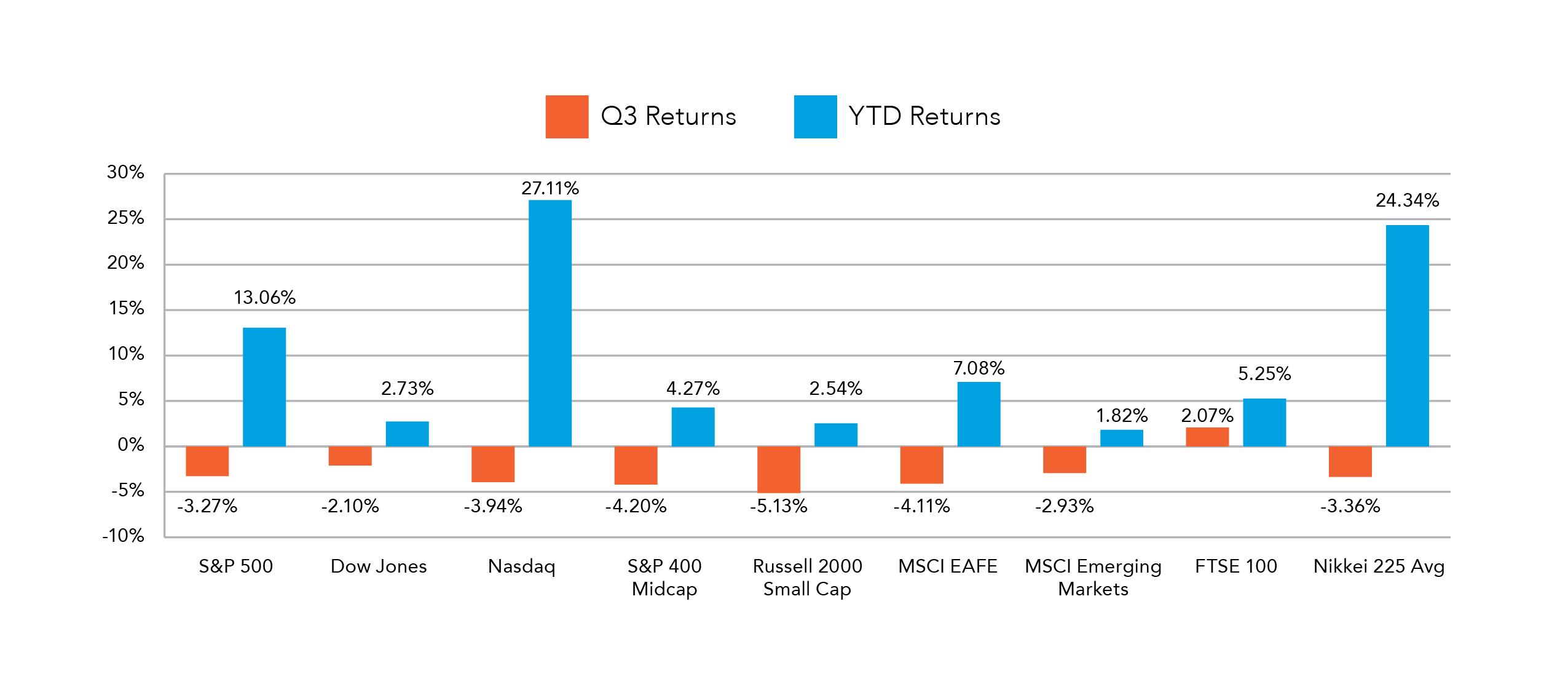

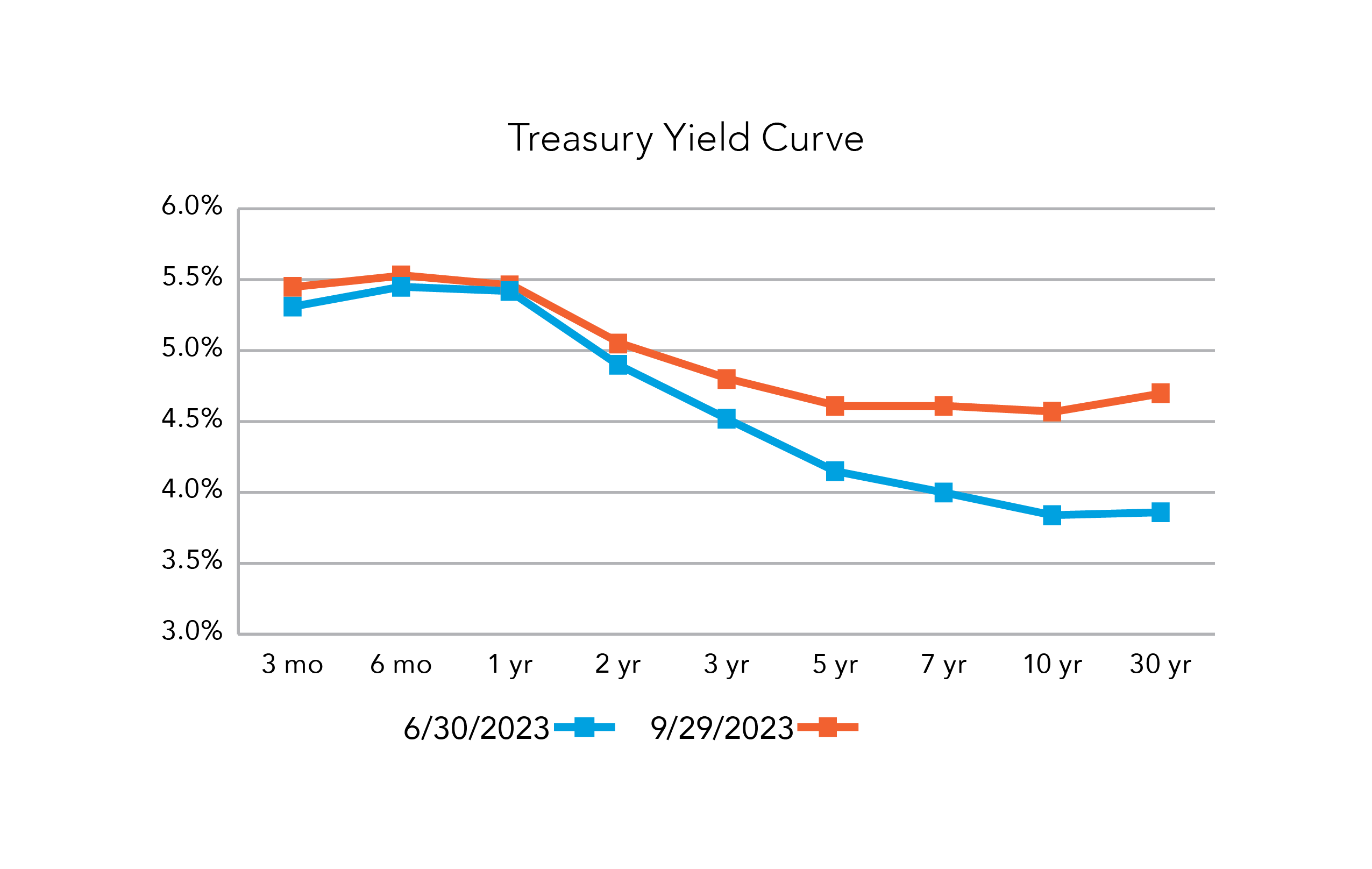

Most inflation readings in Q3 point to a continuation of the downward inflation trend that has been in place since the recent peak in mid-2022. We will be watching to see how much the recent surge in oil prices offsets the likely moderation of inflation in housing. Volatility may continue in fixed income and equity markets, but long-term investors will benefit from higher interest rates and lower equity valuations.

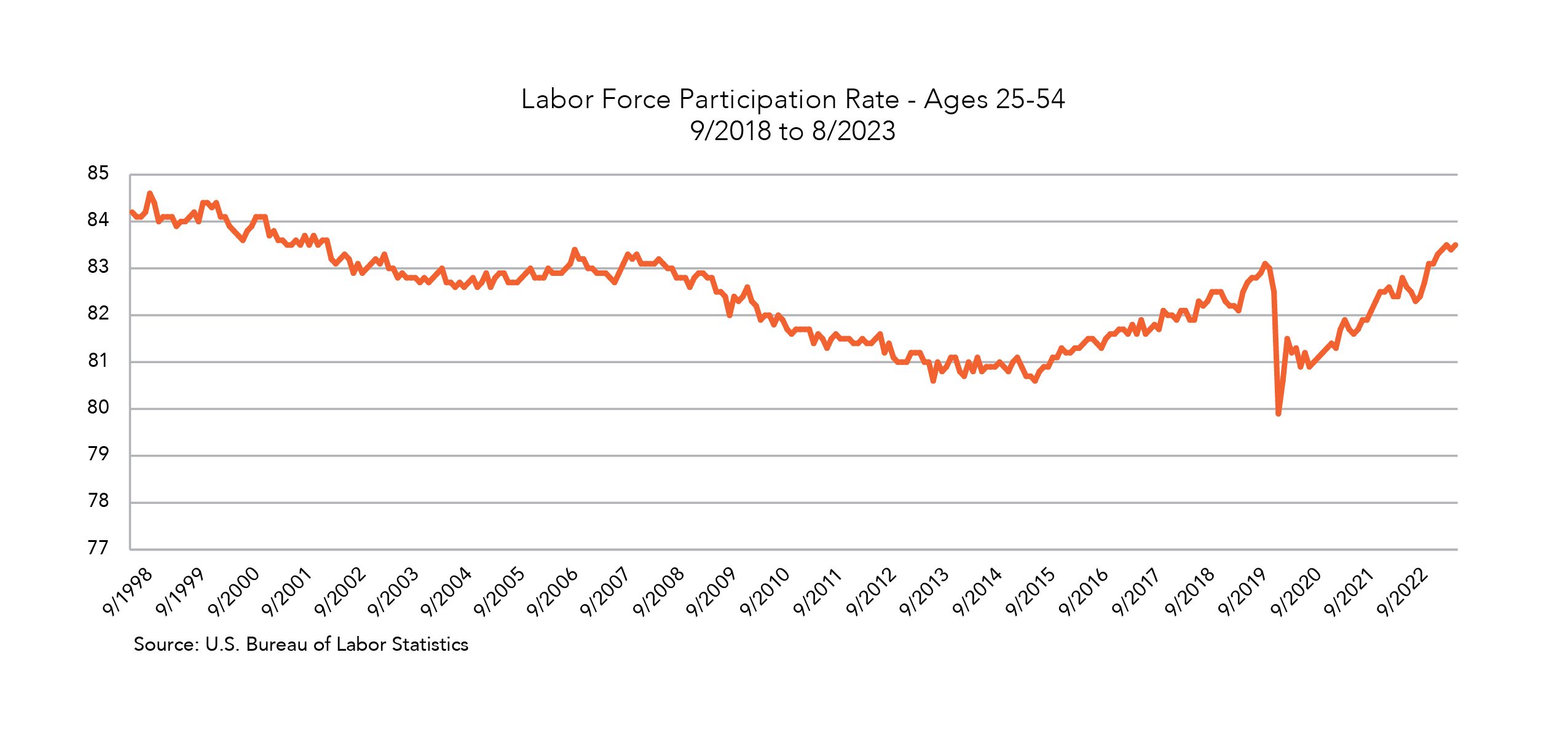

EMPLOYMENT MARKET REMAINS STRONG

Nearly every recession in U.S. history was coupled with a deteriorating employment market. That is why we monitor the employment trends closely. While there have been a few headline-grabbing layoff announcements over the past year, most have been isolated to a handful of technology companies that had been aggressive with their hiring trends in years prior. According to the monthly U.S. Nonfarm Payroll data, there are more than 1.8 million more people working as of August 31 compared to the beginning of the year. While most people are returning to the workforce to fill open roles, some may be reentering due to recent high inflation impact. The labor force participation rate for those 55+ years old remains low following the pandemic, indicating that most early retirees continue to stay in retirement. Meanwhile, higher wages seem to be drawing younger workers back into the labor pool. The labor force participation rate for people between 25-54 years old is up to 83.5%, the highest level in over 20 years. It may soon be more challenging to see additional gains in net employment numbers unless some early retirees are drawn back into the labor pool.

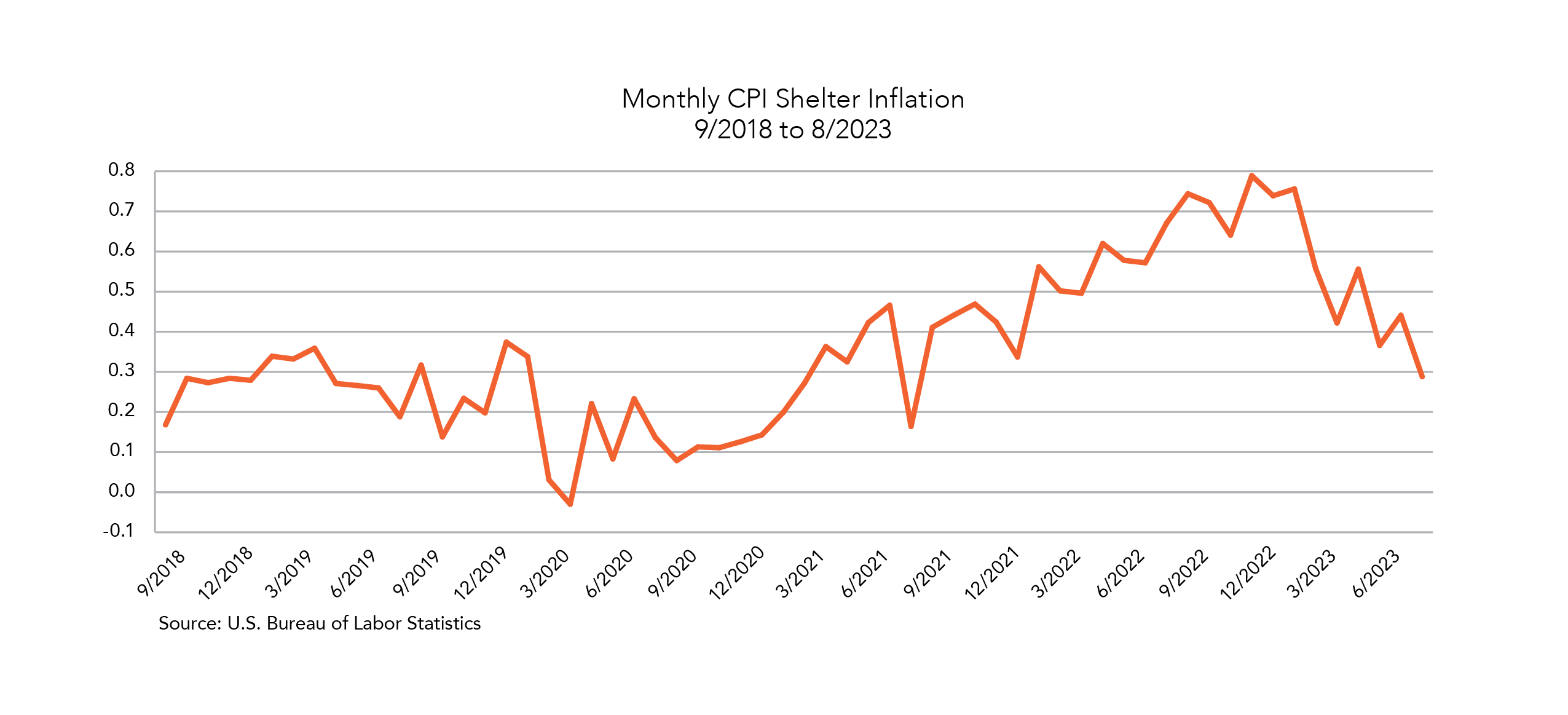

SHELTER INFLATION ROLLING OVER

Investors remain focused on when the Federal Reserve (Fed) will be done raising the federal funds rate, and more importantly, when they may start to cut rates. The key will be the future path of inflation. While the Consumer Price Index (CPI) seems to remain sticky above 3%, it is also important to monitor which segments of the economy are pushing inflation higher. Following the immediate impact from the pandemic in 2020, inflation started to show in physical goods such as lumber, vehicles, and electronics due to production bottlenecks. Then in late 2021 and into 2022, inflation shifted toward various parts of the service-oriented segments of the economy as people started spending more outside of their homes again. As inflation has been moderating in the services sector recently, it has shifted toward higher levels of inflation in shelter over the past year. This is important because shelter, comparable to monthly cost of housing, makes up more than 1/3 of the total CPI index. It is also important to factor in that the shelter component is measured on a lag. The monthly increases in shelter inflation recently peaked in late 2022 to early 2023, which will be rolling off over the next 6-months when looking at year-over-year CPI data. This should help the broad inflation data to continue to moderate unless a new segment of the economy starts to see renewed inflationary pressure.

If inflation data continues to moderate in the months ahead, it should give the Fed the opportunity to slow down additional monetary tightening. More stable interest rates may provide renewed support for the equity market.

VOLATILITY MAY CONTINUE IN FIXED INCOME AND EQUITY MARKETS, BUT LONG-TERM INVESTORS WILL BENEFIT FROM HIGHER INTEREST RATES AND LOWER EQUITY VALUATIONS.

Midland Wealth Management is a trade name used by Midland States Bank, Midland Trust Company, and Midland Wealth Advisors, LLC, a registered investment adviser. Investments are not insured by the FDIC or any other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank or any federal government agency, and are subject to risks, including the possible loss of principal. The information provided is for informational purposes only. Information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed. Midland Wealth Management does not provide tax or legal advice. Please consult your tax or legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. IRS CIRCULAR 230 NOTICE: To the extent that this message or any attachment concerns tax matters, it is not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Past performance is no guarantee of future results. Returns of the indexes also do not typically reflect the deduction of investment management fees, trading costs or other expenses. It is not possible to invest directly in an index. Indexes are the property of their respective owners, all rights reserved. Midland Wealth Management does not claim that the performance represented is CFA Institute, GIPS, or IMCA compliant. Copyright © 2023 Midland States Bancorp, Inc. All rights reserved. Midland States Bank® is a registered trademark of Midland States Bancorp, Inc.