Uncertainty May Lead to Greater Volatility

Fall has arrived with shorter days, cooler nights and leaves showing the true beauty of the season. With the change of season also comes the highly anticipated election with political posturing at the forefront. Uncertainty surrounding the outcome and constant conversation about what each candidate will mean for the market and economy is ever-present and difficult to ignore. In reality, over the long term it hasn’t mattered who was president or which party was in control. The equity market has moved higher during each presidency back to 1930, except for George W. Bush’s terms. Under Bush, the market experienced two recessions and two bear markets (2001-02, 2007-08). The economic environment has a greater impact on market returns than who is in control in Washington.

What does happen during election cycles is increased volatility due to the uncertainty of future policy. This year is no different. What do the candidates’ platforms mean for the market? What is the market impact if Democrats take control of both the House and Senate, as well as the Oval Office? What is the impact if Republicans maintain the Oval Office and Senate or just maintain the Senate? While the ultimate outcome from these respective scenarios is unknown, a brief commentary on each follows:

Trump wins with Republican-controlled Senate, Democrat-controlled House

- Very little change from the current status. A tougher stance on China will be one of his primary areas of focus. In addition, he may introduce further tax cuts for the middle class but odds of it passing Congress are limited.

- Not covered here is a sweep of the House and Senate by Republicans but if that were to occur, policies pursued by President Trump would have a greater probability of enactment.

Biden wins with Republican-controlled Senate, Democrat-controlled House

- A primary focus of this scenario is tax increases. This includes reversal of tax cuts implemented under Trump for corporations and individuals. In addition, capital gains tax would increase, especially for higher income individuals. This may be difficult to implement with a split congress.

- Another topic on Biden’s platform is increased government oversight in many industries including energy, financial services and healthcare to name a few. Once again, a divided congress will make this somewhat difficult to enact.

Biden wins with Democrat-controlled House and Senate

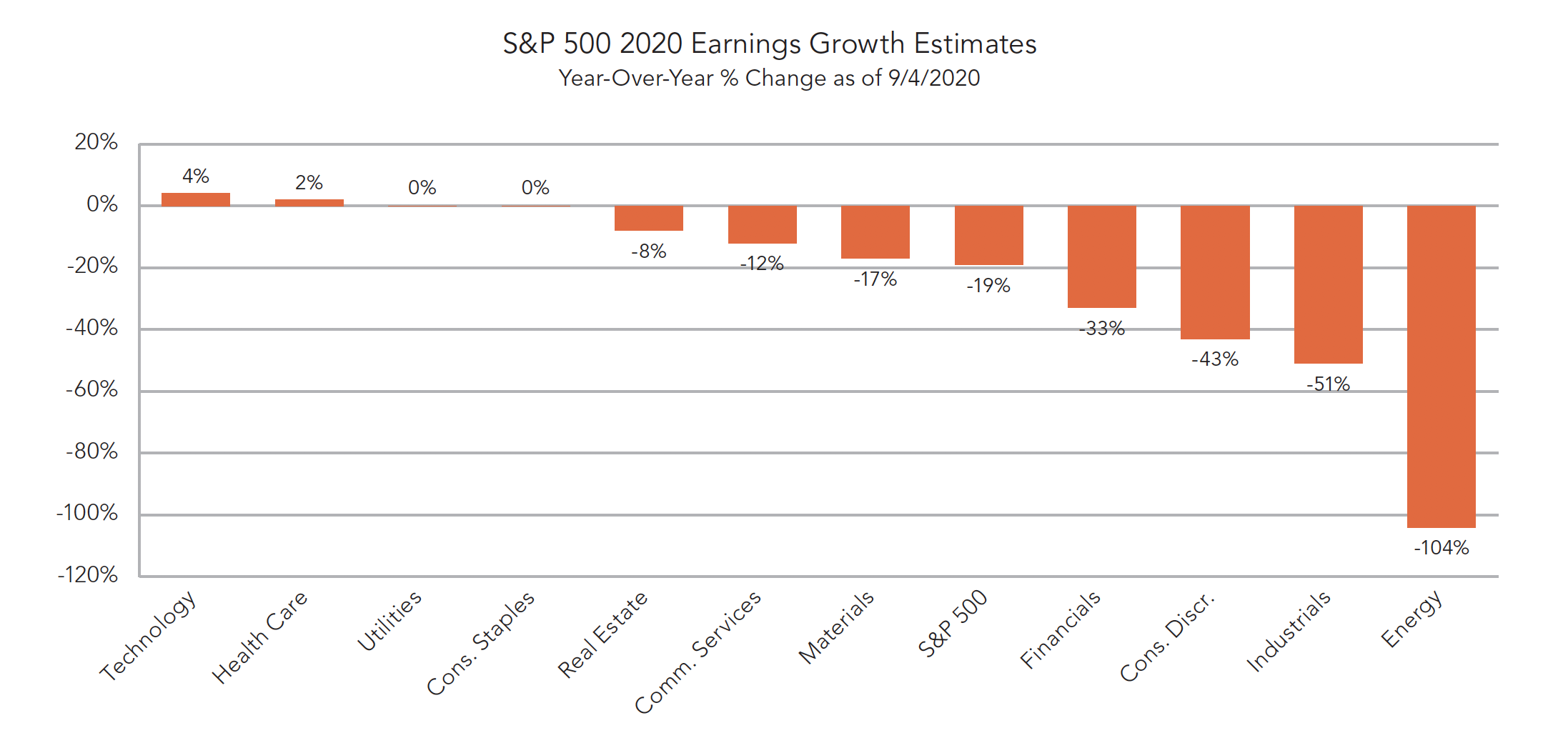

- There is a higher probability of increased taxes passing, which would result in lower earnings for corporations. If implemented early in Biden’s presidency, reduction in 2021 earnings per share (EPS) for the S&P 500 is estimated to be 10% to 12%. Capital gains tax increase may result in selling before year end to take advantage of the lower tax rate.

- Regulations will increase, which typically result in higher costs for corporations.

Although long-term market returns are not dependent on the president or the party in control, congressional checks on the Oval Office have historically been a positive influence on the stock market. When there has been a Democratic president and a split Congress, the Dow Jones Industrial Average has returned 7.99% per year on average. Markets perform well when there is more certainty and minimal change. With a split government, no candidate’s platform will be embraced wholeheartedly, and dramatic changes to policy will not happen.

During the third quarter, equity markets provided positive returns for investors with strong performance in July and August. The S&P 500 experienced one of the fastest recoveries following a bear market, from a record high to a new record. From the February high to a new high in August with a bear market in between, it encompassed only 126 trading days. When analyzing past elections, incumbents are 0-6 when in a recession or if there has been a 20% drop in the market during the election year. Will this market rebound and economic recovery be enough for President Trump to break this trend? This election year is different than the past because the recession and bear market were a result of an exogenous event (COVID-19) rather than the normal business cycle (strong demand, tight monetary policy).

While volatility may increase during this period, ignoring the market headlines and remaining a long-term investor have proven time and time again to be the best decision. Proper assessment of risk tolerance and long-term goals will result in an appropriate asset allocation. No one can control the day-to-day volatility. As history has shown, no matter which party is in control, the market has provided positive returns over the long term.