Soft Landing Achieved

SUMMARY:

The long-awaited recession has not yet arrived. Economic and market indicators have investors wondering if the Federal Reserve has achieved a soft landing.

OUR PERSPECTIVE:

Despite the Federal Reserve Open Market Committee (FOMC) increasing short-term rates by 5% over the last 15 months, the U.S. economy continues to show resilience. However, a recession is still possible with continued FOMC rate increases.

ECONOMY CONTINUES TO MOVE AHEAD

Economic releases have been stronger than expected. The Citi Economic Surprise Index measures data surprises relative to market expectations. If the number is below zero, the economy is not meeting expectations, and if the number is above zero, expectations are being exceeded. The current data demonstrates the economy is stronger in many cases than expected.

HOUSING REMAINS RESILIENT

The housing market has continued to show resilience with an emphasis on new home sales. The inventory of existing homes available for sale remains very low. This is not surprising because few homeowners are eager to sell due to a “mortgage lock-in” phenomenon, after buying or refinancing at much lower rates before 2022. The supply of completed new single-family homes has more than doubled since the bottom in 2022, leading to a decline in the median sales price of new homes by 16% from the peak late last year but has trended upward recently.

LABOR MARKET REMAINS STRONG

The U.S. economy continues to create new jobs with the most recent report showing an increase of 339,000 during May, and the jobs openings remain high at over 10 million. While these appear to be strong numbers, some behind-the-scenes reports do not appear as positive. The weekly jobless claims have increased from under 200,000 per week to the mid-200,000 level. The average hours worked and the number of temporary workers have declined in the most recent reports, which may indicate a slowdown in the labor market. Continued monitoring of this is warranted.

WE MAY SEE SLOWER GROWTH IN THE SECOND HALF OF THE YEAR, BUT THE CONSUMER CONTINUES TO SPEND AND IS EMPLOYED.

INFLATION HAS PEAKED

Inflation numbers remain at levels above where the FOMC is targeting, and the FOMC continues to put fighting inflation as its primary objective. However, the level of inflation has declined dramatically from June 2022 when CPI year-over-year peaked at 9.1%. If we see a neutral inflation number in June 2023, the CPI year over year will be in the 3% to 4% range. While the overall CPI has continued to decline, the Core CPI continues to be sticky. It hit its peak in September 2022 at a 6.6% level, and the most recent reading was 5.3%, which is much higher than the FOMC would like to see. The consumer is still feeling the pain of higher food and energy costs, but the dramatic increase in those prices has stabilized at these higher levels. The areas where the economy now sees continued pressure are insurance, services, travel, etc. The cost of homeowners and auto insurance is increasing substantially during 2023. This makes sense because those premiums are typically determined once a year, and insurance companies are just catching up to the dramatic upward shift in pricing last year. In addition, the demand for travel continues to be strong as consumers take trips that were postponed during COVID. A substantial amount of pent-up demand leads to higher prices. There will be sticker shock during 2023 for many of these services, but like food and energy, we should see less pricing pressure heading into 2024. At that point, Core CPI should be less sticky and follow CPI lower over the next year. The issue will be getting these numbers closer to the FOMC target of 2%. The FOMC will remain vigilant and is expected to increase rates potentially two more times this year.

CAUTIOUSLY OPTIMISTIC

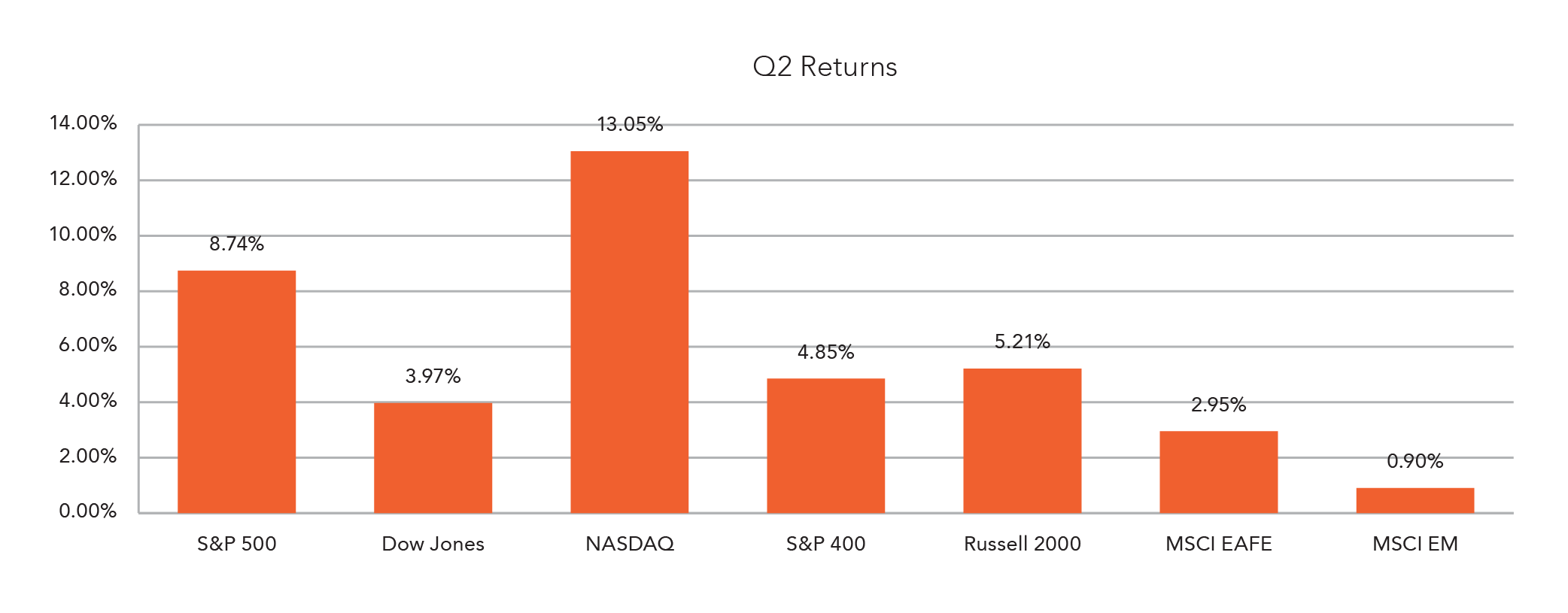

The strong equity market, resilient housing market, and continued strong level of employment have resulted in the average consumer feeling wealthier and more positive. This may put a floor on the growth rate of the economy in the near term. The FOMC will not directly state that the upward move in the equity market is a concern, but the rhetoric that it needs to be vigilant and ready to increase rates certainly is influenced by it to some extent. We may see slower growth in the second half of the year, but the consumer continues to spend and is employed. Maybe the Fed did achieve the soft landing, which is a difficult thing to do. In the meantime, we will continue to monitor the markets and the economy and focus on investors’ long-term goals as we move forward in our investment decisions.

Midland Wealth Management is a trade name used by Midland States Bank, Midland Trust Company, and Midland Wealth Advisors, LLC, a registered investment advisor. Investments are not insured by the FDIC or any other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank or any federal government agency, and are subject to risks, including the possible loss of principal. The information provided is for informational purposes only. Information has been obtained from sources believed to be reliable, but its accuracy and interpretation are not guaranteed. Midland Wealth Management does not provide tax or legal advice. Please consult your tax or legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. IRS CIRCULAR 230 NOTICE: To the extent that this message or any attachment concerns tax matters, it is not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Past performance is no guarantee of future results. Returns of the indexes also do not typically reflect the deduction of investment management fees, trading costs or other expenses. It is not possible to invest directly in an index. Indexes are the property of their respective owners, all rights reserved. Midland Wealth Management does not claim that the performance represented is CFA Institute, GIPS, or IMCA compliant. Copyright © 2023 Midland States Bancorp, Inc. All rights reserved. Midland States Bank® is a registered trademark of Midland States Bancorp, Inc.