Strong Labor Market Fuels Growth

SUMMARY:

The continued strength of the employment market has driven resilient consumer spending and economic growth despite higher interest rates.

OUR PERSPECTIVE:

While we expect job growth to continue to slow, the economy should remain strong as long as the size

of the total workforce remains stable. Higher labor force participation rates have offset a continued wave of retirements.

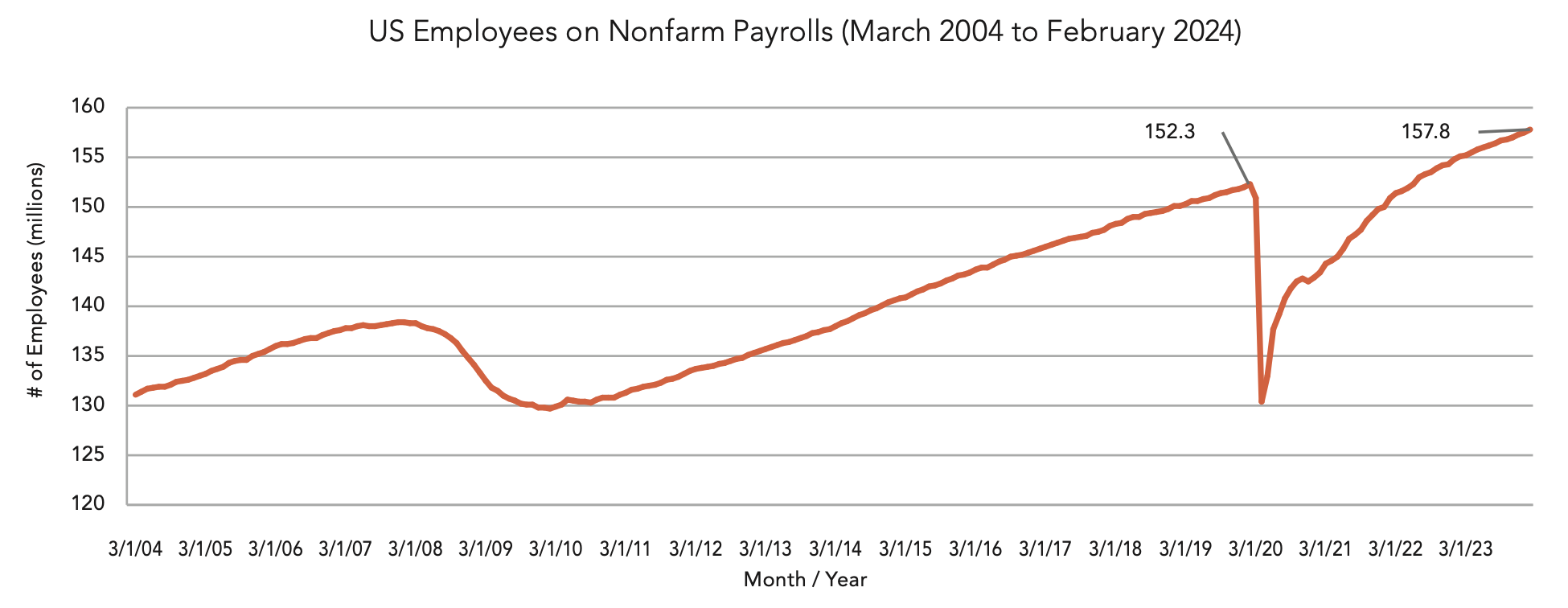

STEADY JOB GROWTH

In the face of higher interest rates, the U.S. economy continues to set new records for the number of people working. This continued workforce growth is a primary driver of increased consumer spending and GDP growth. As long as the job market remains resilient, we do not see a recession in the near term.

Following a sharp rebound in the employment market post-COVID, the pace of new jobs has slowed as fewer new workers are available to enter the workforce. Even with the rate of net new payroll numbers slowing, around 3 million more people are working at the end of 2023 (157.3 million) compared to the end of 2022 (154.3 million), according to the Bureau of Labor Statistics (BLS), as highlighted in the chart below.

THE STRONG U.S. CONSUMER

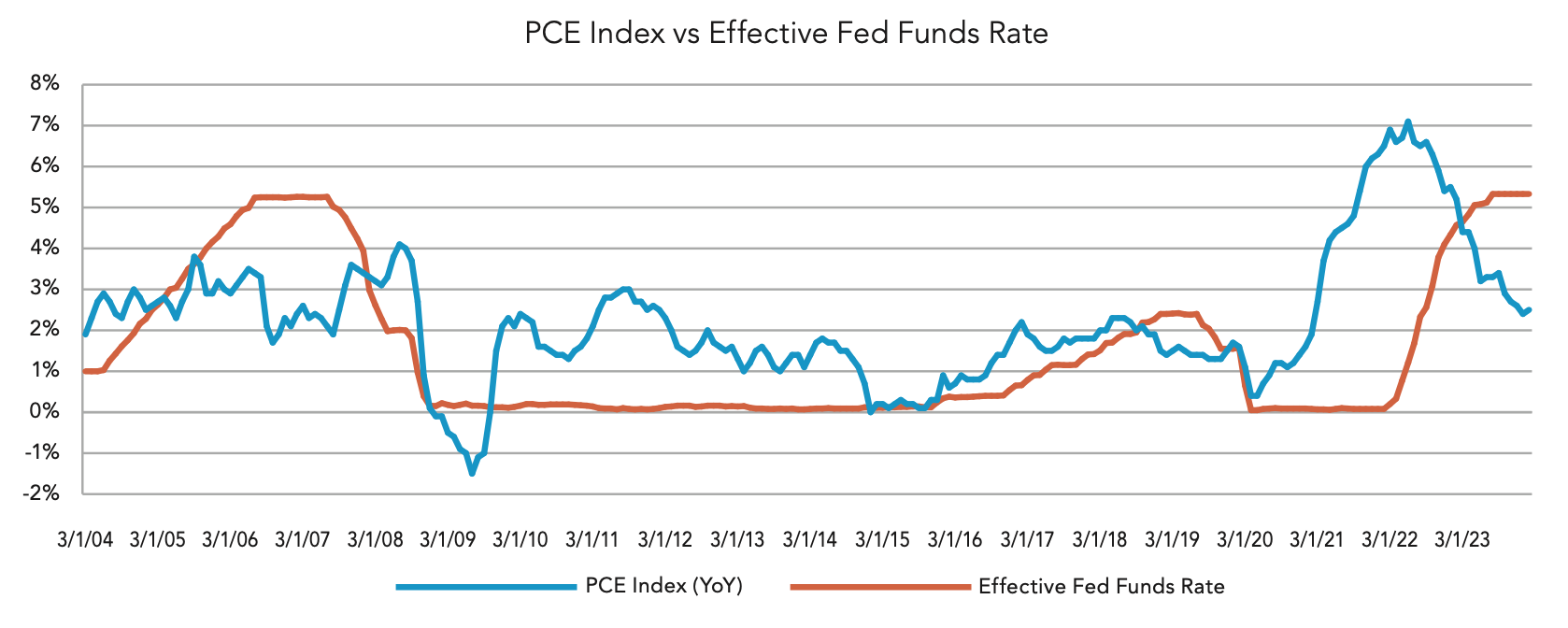

More people working and higher wages continue to boost consumer spending. While this increased spending is a driver of higher inflation, it is also important to note that consumer spending makes up more than two-thirds of U.S. GDP. It continues to be a balancing act for the Federal Reserve (Fed) to reduce inflation while not adversely impacting the job market – which they have so far managed successfully. An early warning sign of an upcoming recession would be net job losses leading to reduced consumer spending.

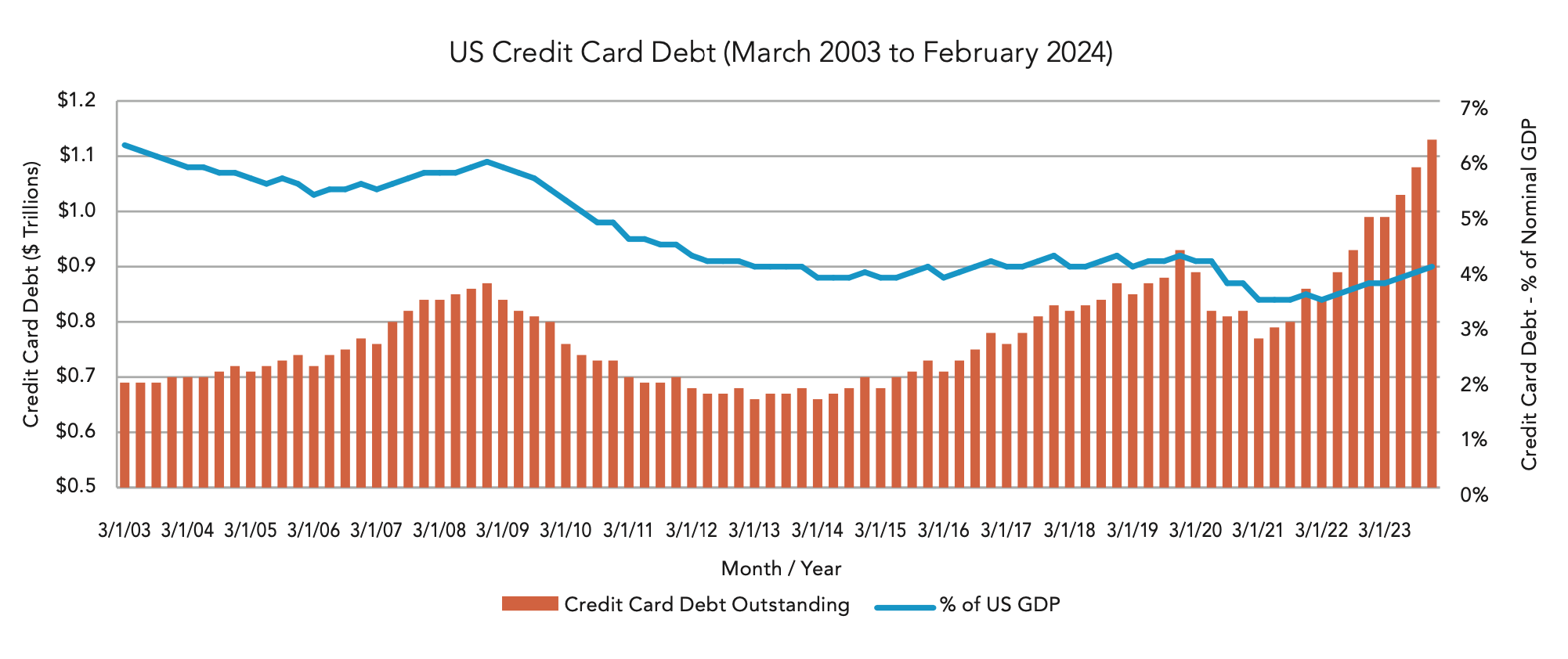

Multiple news stories raised alarm bells over the rapidly increasing credit card debt balances. Despite the negative impact of higher inflation levels, we do not yet view the level of outstanding credit card balances as a warning sign. The size of the debt is large ($1.13 trillion as of the end of 2023) and has increased sharply over the past couple of years, as highlighted in the chart below (orange bars), but it is better to look at those balances relative to the size of the U.S. economy (blue line). In aggregate, U.S. consumers have been deleveraging their balance sheets for most of the past 20 years. When adjusting the outstanding credit card balances as a percentage of the size of the economy, we are back to around the 4% level that we last saw in mid-2020, which remains much lower than most of the past 20 years. While the amount of consumer debt may become an issue that impacts economic growth at some point, we do not yet believe that the current level is cause for concern.

MORE PEOPLE WORKING AND HIGHER WAGES CONTINUE TO BOOST CONSUMER SPENDING.