Inflation, Welcome Back!

For the last two decades, inflation across developed economies has been low to almost deflationary with increased globalization and productivity. As we turned the calendar to 2022, the environment dramatically changed. Year-over-year inflation reached 40-year highs with 7.5% in January and 7.9% in February and is expected to exceed these levels in March. At their most recent meeting in March, the Federal Open Market Committee (FOMC) took the first step in the fight against inflation with a 0.25% increase in the short-term rate and anticipates several more rate hikes in the coming months. What is causing this, and how will it impact the consumer, businesses, and the overall global economy?

The primary causes for today’s inflationary pressures are the extremely accommodative fiscal and monetary policies enacted two years ago in response to the pandemic. In March 2020, the FOMC instantly lowered rates to zero, provided stimulus by purchasing record amounts of government, mortgage, and corporate bonds, and increased its balance sheet from $4 trillion to $9 trillion. When taken in conjunction with government stimulus provided to consumers via direct payments, these actions resulted in a perfect storm of excess liquidity chasing too few goods. The full impact did not become evident until the economic reopening reached a level where consumers could begin spending their extra cash. The average consumer continues to have surplus cash on hand, increasing money spent on services and travel.

Supply chain challenges continue to drive inflation as well. Shutting down the nonessential portion of the economy for an extended period led to shortages. Due to stimulus received during the pandemic, demand for durable goods such as appliances, furniture, and cars increased. As demand increased, the ability to raise prices became more evident. Inflationary pressures should lessen as we work through the shortages. This was a primary reason the FOMC believed that inflation was transitory. In addition to supply chain issues, labor shortages are another disruption, leading to upward pressure on wages. In the past year through March, wage growth increased 5.7% with non-supervisory workers seeing larger increases than management. In the U.S. economy, there continue to be more job openings than the number of people unemployed. This imbalance may continue to influence businesses to pay higher wages or limit services available.

The final dagger in the inflationary topic was the Russian invasion of Ukraine. This action led to a spike in energy costs as well as future food price inflation, especially in Europe. Europe had finally reopened after the pandemic and showed signs of solid growth. Higher inflation may now have a negative short-term impact on its growth rate. Because the U.S. is fairly energy independent and is a global provider of grains, its economy should see less of an impact in the long term. The events in Europe are still impacting the price U.S. consumers pay at the pump and the grocery store though.

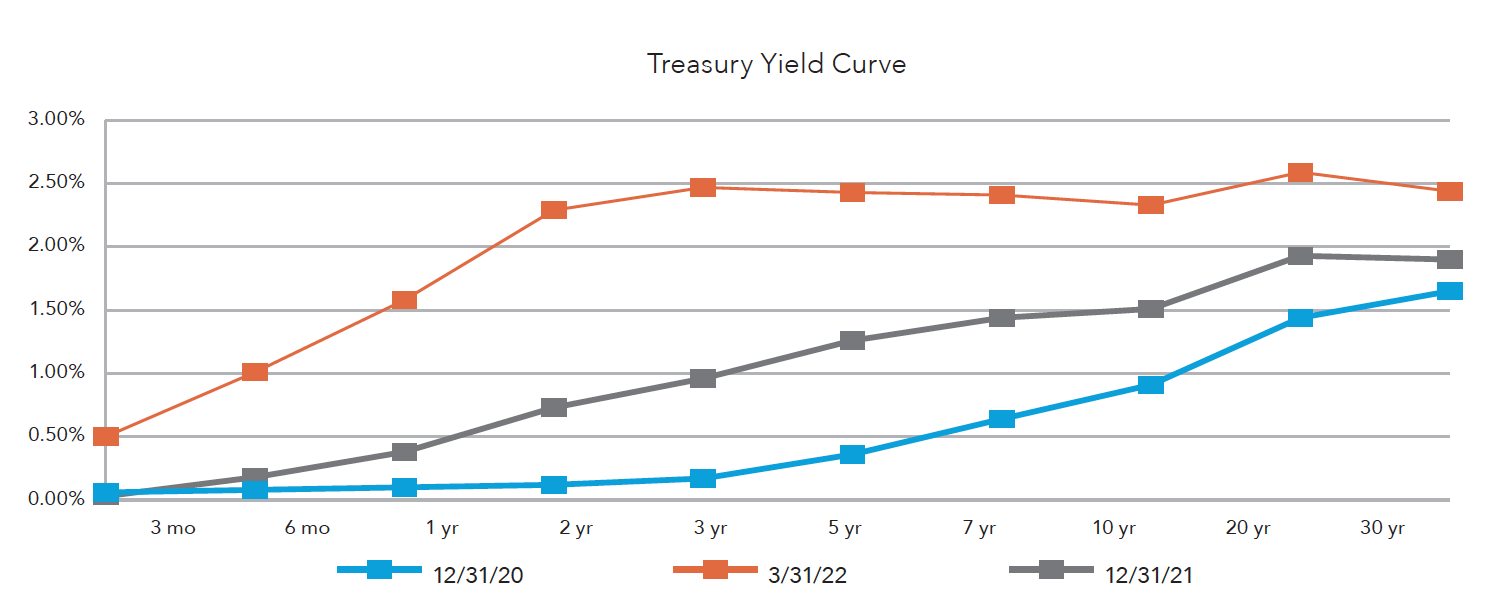

What does this mean for economic growth and the markets? Realizing that inflation is not transitory, the FOMC has initiated a period of interest rate hikes and moved to reduce its balance sheet to slow demand and lower inflation. The first action in March to raise rates by 0.25% was expected, but the FOMC’s dot plot chart shows a steeper and quicker reaction to fight inflation. The next move will likely be a 0.50% increase in May, with the short-term rate expected to near 2.25% by year-end 2022. The bigger question is whether the FOMC needs to be more aggressive, which could lead to a recession. The FOMC’s goal is to achieve a soft landing that does not result in a recession.

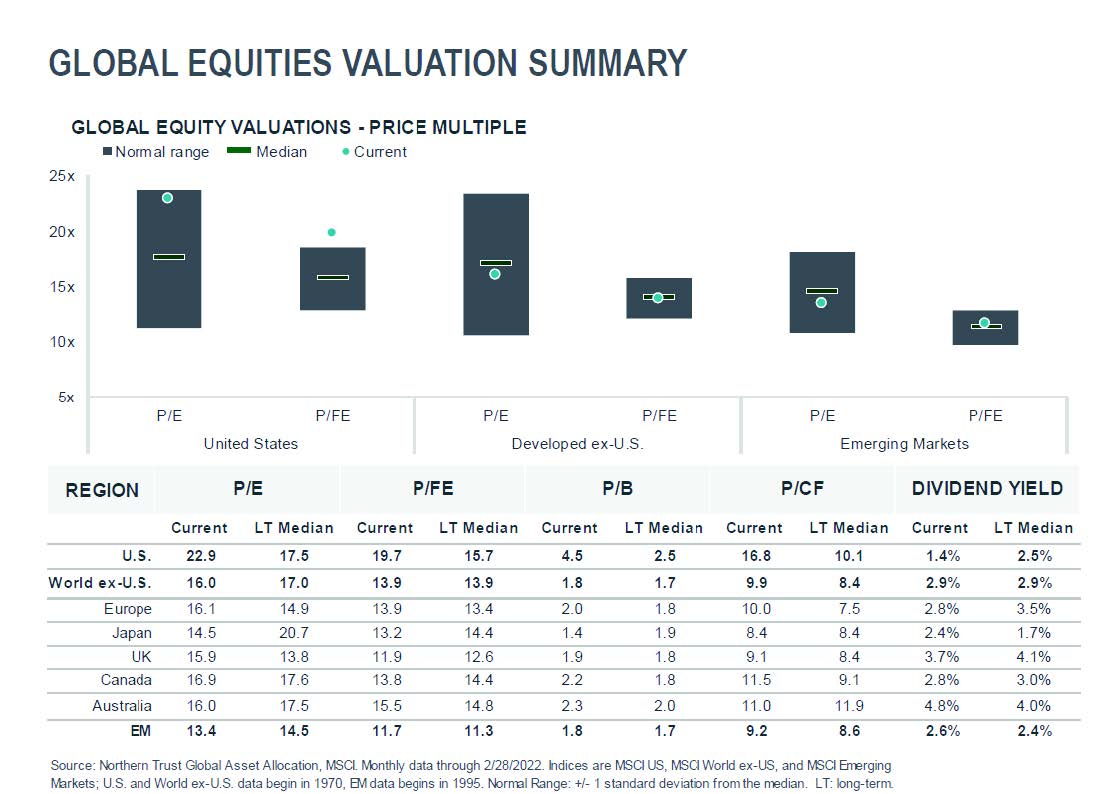

While there are risks to overall economic growth, global growth, especially in the U.S., is in a strong position heading into this tightening cycle. Consumers and businesses have stronger balance sheets and more liquidity at this point in the cycle compared to other market cycles when the FOMC began monetary tightening. In addition, we have seen a substantial revaluation in both the equity and fixed income markets during the first quarter. In the fixed income market, we have seen the largest drawdown in bonds and the most negative total return. While we may not be at the peak of this interest rate cycle, the yield curve out two years and longer has already built in at least a 2.25% short-term rate. If the FOMC does not have to be more aggressive, we may have seen the worst for the bond market, and higher yields may offer some value at this point. In the equity market, valuations in some sectors and individual stocks remain high, but much of the speculative portion of the market has had a substantial repricing since the end of the first quarter last year. Many of the stay-at-home stocks that spiked dramatically in 2020 and early 2021 have receded by over 50%. In the most recent correction, the S&P 500 declined around 10%. However, when looking at individual names in the index, over half declined more than 20% and were in bear market territory.

Overall, we expect economic growth to slow from the rapid pace experienced in 2021 to a more reasonable 3% to 4% GDP growth rate in 2022. While the probability of a recession is higher than at the beginning of the year, we do not envision one in 2022. Talk of an inverted yield curve, high inflation, and all the risks associated with a recession may be valid, but historically an inverted yield curve has not always predicted a recession. Also, a true inversion is when the 3-month treasury yield is greater than other maturities across the curve, which typically happens further into the FOMC tightening cycle. Higher costs for food and energy may limit the amount of discretionary spending by consumers, leading to slower growth and less pricing pressure for these services and products. While higher costs may sound negative, from the FOMC’s perspective, they may help lower the inflationary pressures we are experiencing.

We continue to be long-term investors and believe there is a need for a diversified portfolio invested in bonds, stocks, and alternatives.