What a Difference a Year Makes

Over the last 12 months, it seems as though we have been living in the middle of a science fiction movie. Mask wearing, social distancing and economic shutdowns would not have seemed within the realm of possibility prior to March 2020. As of this writing, we have been enduring this for a year. The reopening of the economy is under way and our lives are slowly returning to a more normal pace. When reflecting on the past year, it is mind boggling that scientists and pharmaceutical companies were able to create and receive approval for three vaccines, as well as produce and distribute substantial amounts to U.S. citizens. By mid-March, over 128 million doses have been given in the United States with greater than 45 million people or 14% of the population fully vaccinated. With the speed of production and distribution increasing daily, we are hoping to reach 75% of the population by mid to late summer. By attaining this level, the U.S. will reach herd immunity allowing for extensive travel, large venue events and a return to a more normal life.

The economic recovery has been strong, with 2021 GDP forecasted to exceed 6%. There are several reasons for the strong recovery, including over $5 trillion in government stimulus, swift monetary policy action from the Federal Reserve (Fed) and the state of the economy prior to the shutdown. We have covered this several times in these writings, but this was not a normal recession caused by overheating and tightening monetary policy. Individuals and corporations were in fairly strong financial positions heading into the short downturn, allowing for a fairly quick recovery when the economy reopened. The stimulus has provided incentive for additional spending, as well as saving. This is all positive, but the higher level of government debt and the fear of higher inflation are certainly longer term concerns.

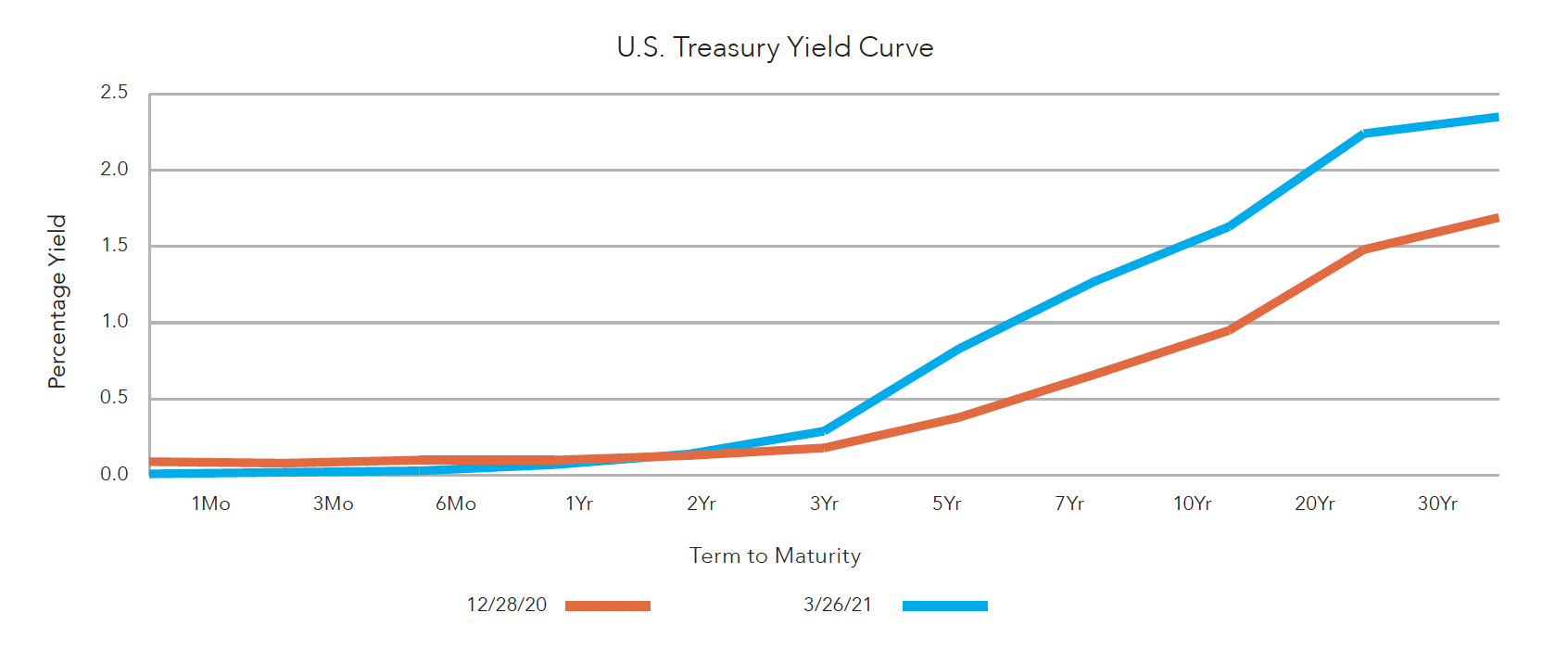

One of the consequences from last spring’s shutdown is a diminished supply chain and potential for higher inflation numbers. In January, the bond market became concerned about inflation risk, resulting in higher intermediate and long-term interest rates. As manufacturers ceased to do business from March to May and shipping containers stopped moving, inventory levels declined as demand exceeded supply. This continues to be an issue today. It is prevalent in the automobile industry, where semiconductor chips are needed for automobiles and manufacturers are unable to obtain enough supply. These shortages have led to slowdowns in production lines for new cars and trucks, limiting supply at dealerships. Many of us learned in our basic economics class that when demand exceeds supply, prices typically increase. This occurs in both the new and used car markets. If individuals cannot buy a new car, there will be a shortage of used cars in the market from sale or trade-in. This is just one example of manufacturing supply chain issues, but there is also limited availability of appliances, as well as furniture and lumber, resulting in longer wait times for delivery and higher prices.

Weather, ranging from hurricanes to deep freezes to flooding, has also impacted the supply chains. Oil supply declined dramatically last year with a decrease in rig count, but as the economy has recovered, demand for gasoline has increased. It is believed that gasoline alone will lead to a 2% higher inflation rate than a year ago. In addition to supply chain issues, a common thread in the manufacturing sentiment measures is the shortage of employees and the need to hire more. As a result of this manpower shortage, wage pressures may increase. Summing up all these concerns leads to a higher inflationary environment. Spring 2020 was a deflationary environment, but the strong economic recovery and demand will certainly lead to a spike in inflation on a year-over-year basis during the 2nd quarter. The real question is whether this is transitory (short-term) or a longer-term issue. We will continue to monitor the situation.

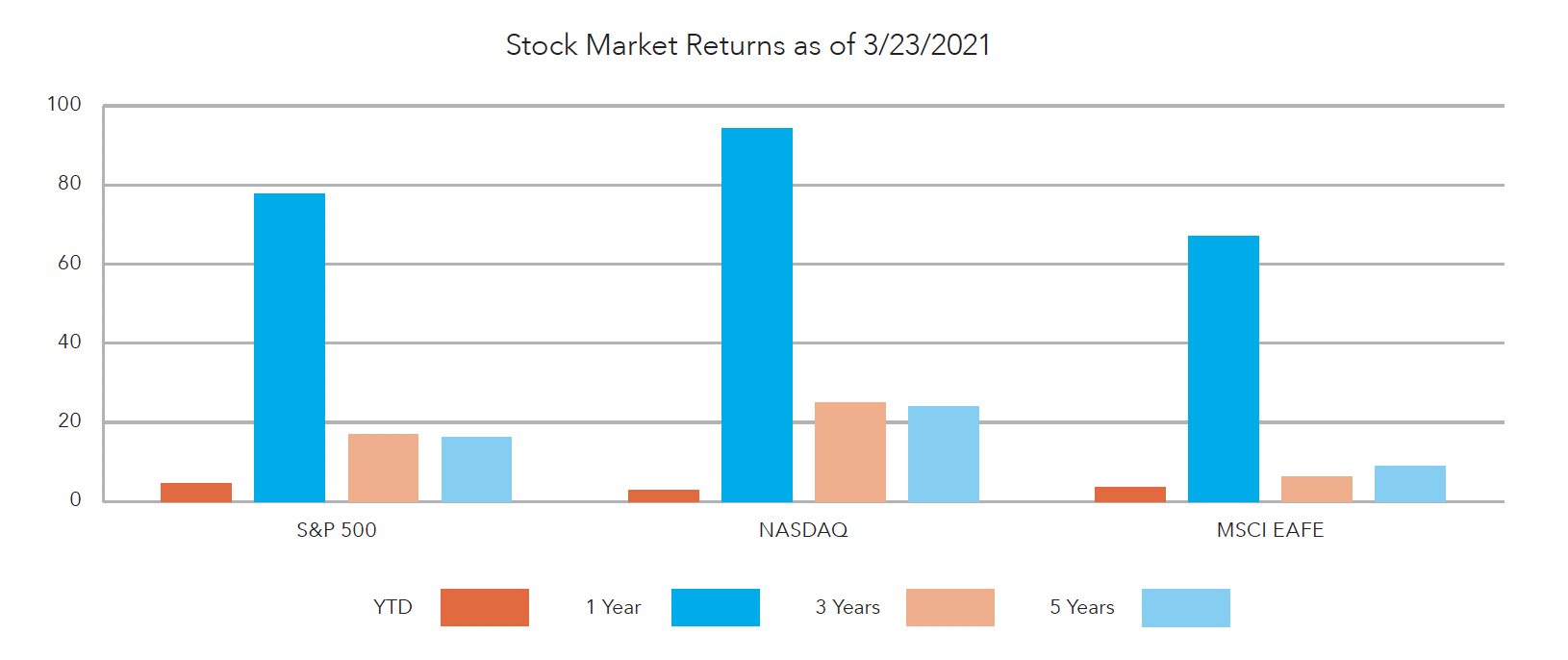

Inflation fears, along with a strong economic recovery and increased government debt, have resulted in higher intermediate and long-term interest rates. With rising interest rates and a stronger economy, the equity markets have begun a rotation from higher-valued technology stocks to cyclical companies that perform well in an expansionary environment. The past 12 months have provided phenomenal returns to stock investors and we believe there is still upside in the markets, but there will also be increased volatility as the market comes to terms with a higher interest rate environment. Considering this outlook, we continue to have an overweight position to equities, along with a slight underweight to fixed income.