Farewell to 2020, Hello to Hope and 2021

At the beginning of 2020, there was little expectation of a recession or a bear market. However, a virus originating in China threw the world into one of the sharpest declining growth periods it had ever seen, and the reversal was almost as extreme. While the overall growth rate of the U.S. economy will more than likely be negative for the year, the rate of recovery in the third and fourth quarter has been phenomenal. As we have discussed in earlier writings, this was not a typical recession caused by overheating, supply shortage, or Federal Reserve (Fed) tightening, but rather an exogenous event that basically shut down the economy in a quick fashion. Rapid action by the Fed to provide substantial amounts of liquidity, as well as fiscal stimulus by the government, helped deter the economy from falling into an abyss that may have resulted in a much longer recession and painful recovery. As the economy began to reopen in late spring and early summer, it was evident that there was pent-up demand in housing, home improvements, car sales, and most areas of the economy not related to travel or large gatherings. The human spirit found a way to make things work in a new environment. The equity market responded with a quick upward trajectory off the lows seen in March. As of this writing, most indices are near all-time highs, and interest rates are near all-time lows.

As we roll into 2021, there is reason for optimism and hope. Two vaccines for COVID-19 are approved and being distributed with additional vaccines in the works. Frontline and essential workers and the elderly should be immunized by the end of the first quarter, and a majority of the population being vaccinated by the third quarter is likely. The third of our economy that has been in limbo since March will be able to reemerge and begin functioning in a more normal environment. This alone will lead to growth in the second half of the year with an increase in travel and entertainment. We realize that there are many that have suffered during this time from loneliness, unemployment, and business closings, and the long-term effects are yet to be determined. As it was once said, it is darkest before the dawn, and we may be at the darkest point this winter with an increased surge in cases and additional lockdowns and restrictions. Continued stimulus from the government is being provided to help small businesses and workers impacted by the pandemic.

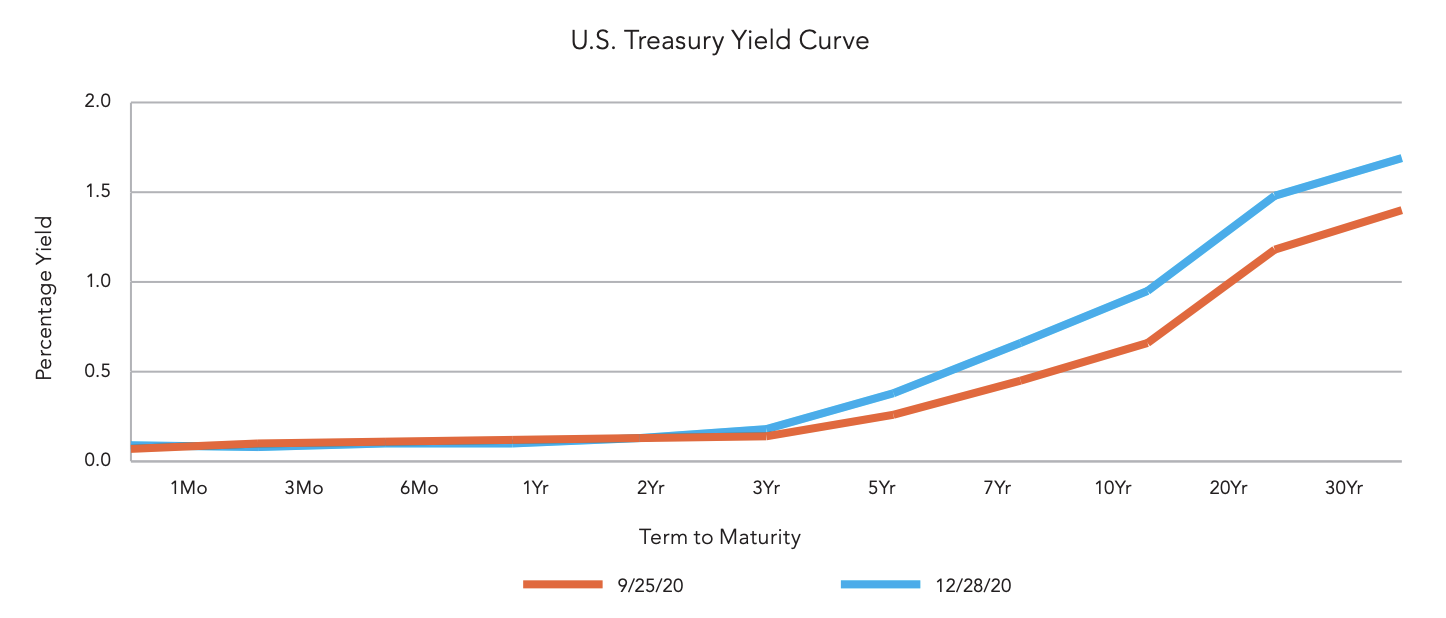

While the first half of 2021 may exhibit slower growth, we do envision the U.S. GDP growth for the upcoming year to exceed 2%. Inflation may move slightly higher with pent-up demand in certain markets driving prices higher due to limited supply. Interest rates will likely remain anchored at ultra-low levels on the short end, while the longer end of the treasury curve may slightly steepen. Earnings should increase year over year with an improving economy, especially for companies whose business was more dramatically impacted by the lockdowns. With the election results, other than the Georgia Senate runoff, known as of this writing, the Biden presidency may provide some changes to the business climate, but businesses adjust to changes. Increased employment in the second half of the year will add to demand for products and services. With the pandemic ending, both U.S. and foreign economies will be stronger and provide more earnings growth and market opportunities. We cannot minimize the impact of massive stimulus from governments and central banks heading into the New Year. Putting all these factors together leads us to believe the equity markets should provide positive returns in 2021. With interest rates so low, fixed income investors will struggle to earn returns that exceed inflation. Considering all these points, our asset allocation leans us to slightly overweight equities heading into 2021. In addition, we are underweighting fixed income and shortening the average maturity, or duration, in our fixed income portfolios due to increased interest rate risk from these levels.

This past year has been challenging, to say the least, for everyone - on a personal and business level. We have survived a recession, experienced a once in a lifetime pandemic (we hope) and went through the election cycle with minor upheaval. The one thing this past year has demonstrated is that people are innately strong and resilient to disruptions, coming out on the other end better for the wear. It has taught many of us what is important in life and to value every minute we can spend with family and friends. Here’s to a wonderful 2021 and to the day that we can all meet face to face and enjoy each other’s company again.