What is the Illinois PTE tax?

In August 2021, Illinois joined several other states in enacting an elective tax on Pass-Through Entities (PTEs). A PTE can be a limited liability company (LLC), S Corporation, or partnership. Under this legislation, a PTE can elect to pay the PTE tax on its net income. The PTE tax is 4.95%, which is the same flat rate as the Illinois individual income tax rate. The owner(s) of the PTE may then claim a credit against their Illinois income tax liability for their share of the PTE’s net income.

Why would a PTE voluntarily elect to pay this tax?

A PTE may elect to pay this tax in order for the PTE owner(s) to save on their federal income taxes. Of course, this seems counterintuitive: how does paying one tax (the PTE tax) save on another tax (the business owner’s federal income taxes)?

The answer is this: because an individual’s ability to deduct state taxes on their federal income taxes is now limited to $10,000 (what is called the “SALT” deduction cap), the PTE tax is a work-around: the Illinois PTE tax paid by the business is a federally deductible business expense. This expense lowers the amount of taxable income the business entity passes through to the business owner. The business owner accordingly is paying less federal income tax because they receive less income. The owner ALSO may claim a credit against its Illinois income tax liability equal to the owner’s share of the PTE tax actually paid (which should, in most cases, result in the owner NOT incurring any additional Income tax liability for the income received from the business).

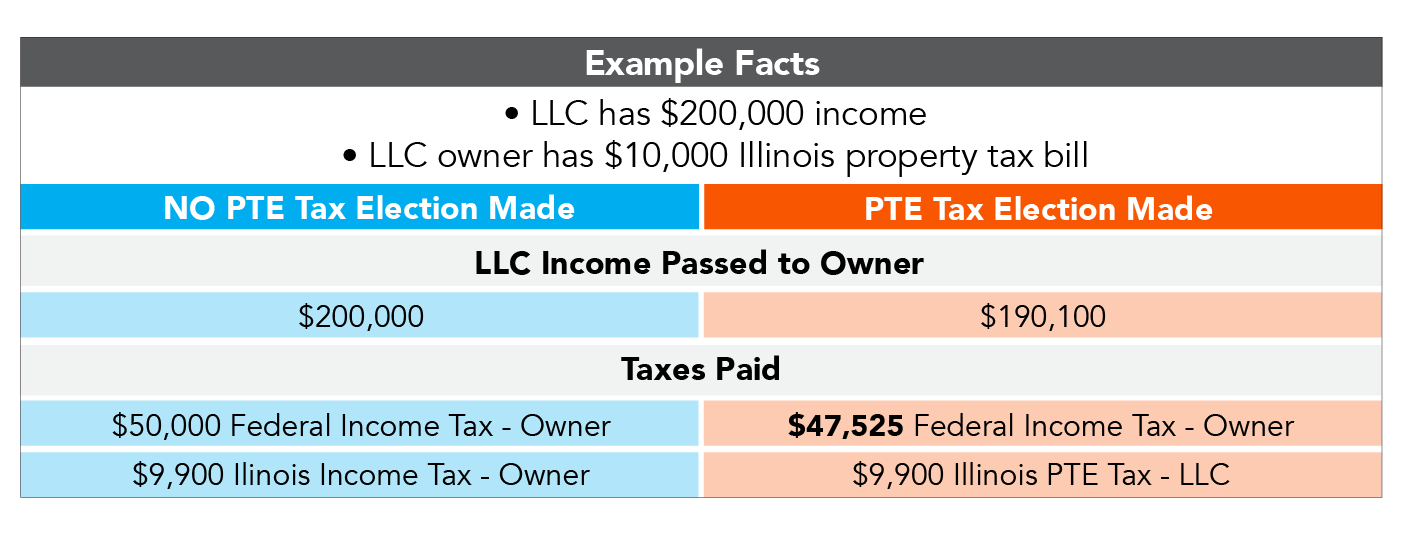

Consider the following example to show how the Illinois PTE tax could result in tax savings:

- Assume we have an Illinois LLC owned by a small business owner. In 2021, the LLC made $200,000 of net income. The owner resides in a home with a $10,000 Illinois property tax bill.

- If the business does NOT elect to pay the Illinois PTE, the LLC would pass through the $200,000 of income to the owner and the owner would pay Illinois income tax at a rate of 4.95%. Unfortunately, this tax bill of $9,900 would NOT be deductible on the owner’s federal income tax return because they have already reached the “SALT” deduction cap of $10,000 (from their property tax bill). Accordingly, the owner will pay federal income tax on the full $200,000 of income received from the LLC. If their effective tax rate is 25%, this is a tax bill of $50,000.

- If, however, the LLC elects to utilize the Illinois PTE, this scenario looks different:

- The LLC elects to pay the Illinois PTE tax, which is 4.95% ($9,900) of its net income.

- This payment is a business expense and fully deductible by the LLC, reducing its net income to $190,100. The owner receives $190,100 from the LLC, as well as an Illinois income tax credit of $9,900 for the amount of Illinois PTE tax paid by the LLC.

- The owner pays federal income tax on the $190,100 received from the LLC, for a tax bill of $47,525. The owner saves $2,475 in federal income taxes!

- The owner pays no Illinois income tax due to their Illinois income tax credit of $9,900.

A chart demonstrating the tax savings of the above narrative is as follows:

Based on the above, business owners who have structured their business using a pass-through entity should be aware of the Illinois PTE tax and ask their tax preparer if making this tax election will help them save on taxes.