Summary:

After valuation resets, private real estate benefits from improving rate dynamics, constrained supply, and structural demand, particularly industrial, offering income, diversification, efficiency, and asymmetric upside for investors.

Want a broader view of this quarter’s trends? Download the full market outlook for insights across the economy, equity, and private markets.

Our Perspective:

From a portfolio construction standpoint, private real estate plays a complementary role alongside public markets, providing stable cash flows, lower volatility, and exposure to long-term property fundamentals that are less influenced by short-term market movements.

PRIVATE REAL ESTATE 101

While prior discussions have focused in part on public REITs, several emerging tailwinds warrant a closer look at private real estate. Unlike public market counterparts, private real estate (PRE) is driven less by market sentiment and more by underlying property fundamentals and long-term income generation.

Because PRE is more closely tied to fundamentals, valuations tend to exhibit less short-term volatility than publicly traded REITs. Asset values are typically determined through periodic appraisals or transactions rather than daily market pricing, resulting in a smoother return profile over shorter time horizons.

From a macro perspective, PRE remains sensitive to interest rates, though often in a more balanced manner. Higher starting income levels can help cushion returns during periods of rising rates, while falling rates may support asset values through lower financing costs and modest cap rate compression.

Like public REITs, PRE is characterized by an income-oriented return profile. A key distinction, however, is that REITs are required to distribute at least 90% of taxable income to maintain their status. While these dividends are not qualified, they are generally eligible for the 20% qualified business income (QBI) deduction. By contrast, income from PRE often benefits from a depreciation tax shield and is largely characterized as return of capital, effectively deferring taxes until the underlying assets are sold. As a result, PRE tends to be more tax-efficient over the long term relative to traditional REIT exposure.

For investors with longer time horizons and lower liquidity needs, PRE can play an important role in portfolios as a source of stable income, diversification, and a hedge against inflation.

MACRO DYNAMICS SUPPORT PRIVATE REAL ESTATE

There is no single tailwind driving PRE. Rather, a combination of structural and cyclical forces is converging to support durable demand across the asset class. Following the post-pandemic rise in interest rates, PRE experienced a material valuation reset, with asset values declining approximately 22% from their 2022 peak as cap rates moved higher. This adjustment has left PRE trading at a relative valuation discount, with income yields meaningfully higher than just a few years ago.

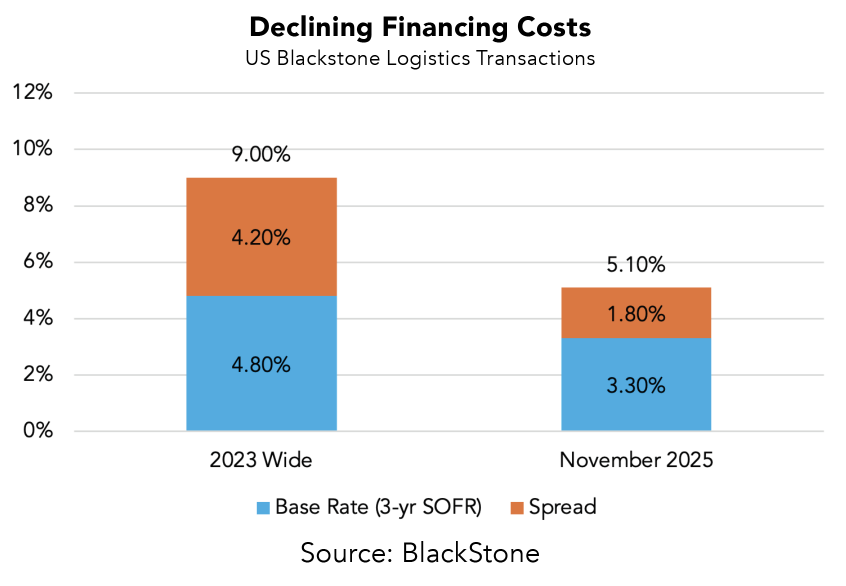

Interest rates are increasingly viewed as a tailwind rather than a headwind for PRE. While a sharp decline in rates is unlikely, gradual easing has meaningful implications for PRE fundamentals. Since peaking in 2023, debt financing costs have declined from 9.0% to 5.1% in November of last year, supporting improved cash flows, modest cap rate compression, and increased transaction activity as bid-ask spreads narrow. With much of the rate-driven downside now captured, PRE presents a more favorable asymmetry, offering upside potential if rates fall, while income helps support returns, should rates remain elevated.

Opportunities within PRE are not evenly distributed. A full return to in-office work has yet to materialize, which may continue to weigh on office valuations and reinforce sector polarization. Capital is increasingly gravitating toward property types supported by durable, structural demand.

Industrial and logistics assets sit at the intersection of several powerful trends, including supply-chain reconfiguration, domestic manufacturing investment, and infrastructure-related fiscal spending. At the same time, supply conditions have shifted decisively. Following a post-COVID surge, new industrial construction has declined sharply, with starts down more than 60% from recent peaks as higher construction costs, tighter financing conditions, zoning limitations, and power constraints render new development increasingly uneconomical.

Against this backdrop, demand has remained resilient. Rising e-commerce penetration, inventory restocking, and reshoring activity continue to drive space needs, with each 1% increase in e-commerce share estimated to require 50–70 million square feet of industrial space. Together, constrained supply and structurally driven demand support occupancy, rent growth, and pricing power for well-located industrial assets.

In our view, these dynamics strongly support a strategic allocation to private core and core-plus real estate within diversified portfolios. Following a meaningful valuation reset, the asset class now offers improved income yields, more favorable rate asymmetry, and exposure to property fundamentals supported by long-term structural demand. We believe the opportunity is most compelling in high-quality, meaningfully levered strategies with an emphasis on income durability, particularly those anchored by industrial and logistics assets.

Private real estate offers a unique mix of income, stability, and long-term opportunity—especially in sectors with structural demand.

Interested in learning more? Connect with a Midland Wealth Advisor today