Summary:

In a departure from previous outlooks, we take this opportunity to evaluate major factors that had an outsized effect on investment performance in 2025, discuss what worked well and what ideas had lackluster performance, and provide an outlook on opportunities and risks in 2026.

Want a broader view of this quarter’s trends? Download the full market outlook for insights across the economy, equity, and private markets.

Our Perspective:

Coming out of 2025, the market is still negotiating the same three factors but is doing so with a different temperament. Trade policy remains a live variable, deficits continue to shape yield curves, and a shift back toward accommodative monetary policy, in light of a growing economy, will impact asset prices.

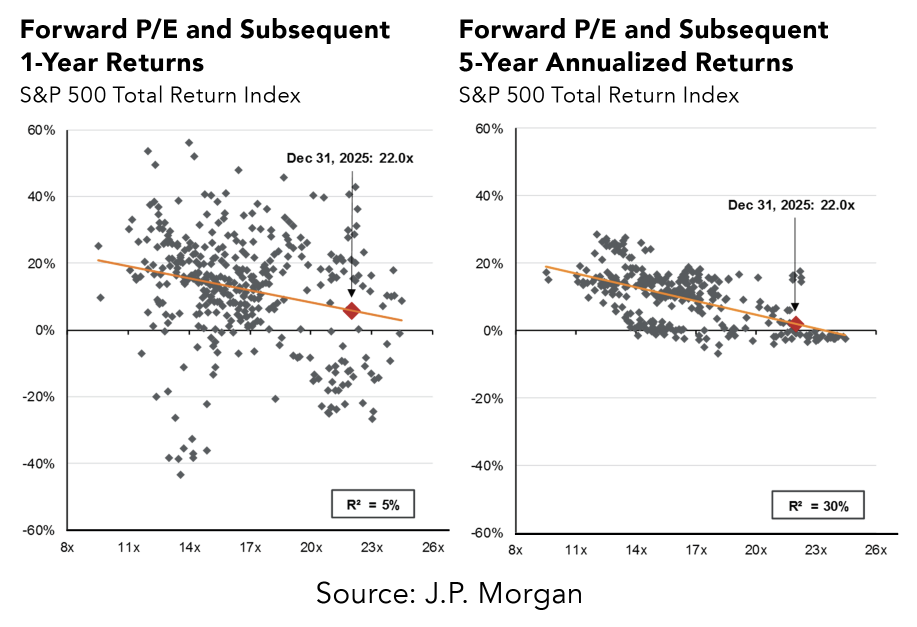

For 2026, the team believes the market’s central question will shift. The last two years were dominated by the level of rates and concentration of returns. This year is increasingly about the distribution of earnings and who can credibly deliver productivity, margin durability, and improved returns on capital.

This is why we are focused on three themes: (1) fiscal thrust that supports demand, (2) an S&P 493 broadening that becomes fundamental rather than aspirational, and (3) artificial intelligence’s move from infrastructure to application, particularly in productivity constrained sectors where valuation multiples can expand as fundamentals improve.

2025 ECONOMIC AND POLICY REVIEW

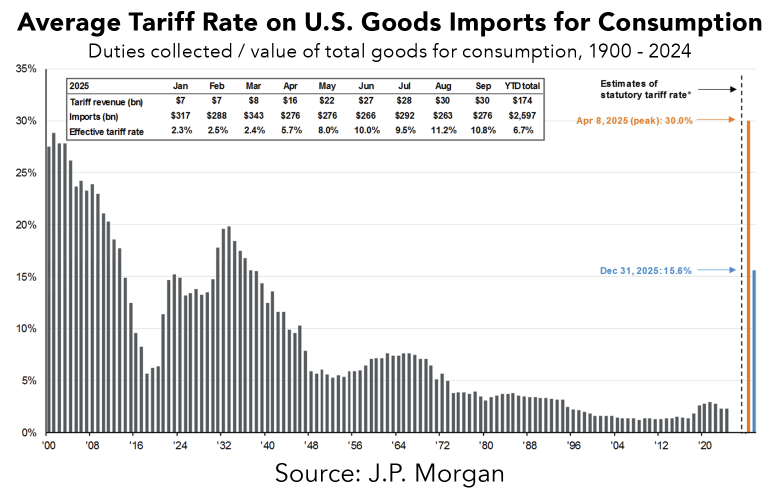

A tariff is a tax on imports. The reason this matters is not academic; it’s mechanical. Higher prices initially affect purchasing power, then the economy moves through a decision tree: consumption, wages, productivity, and aggregate demand. That framing was helpful in 2025 because it forced us to look past the initial price effect and focus on the second-order impacts that determine whether a shock becomes a slowdown.

By the third quarter, the average trade-weighted tariff rate was 16% (or about 9% excluding court-challenged tariffs), and the business impact wasn’t just mathematical. It directly metastasized in planning risk, as stable input prices are a prerequisite for long-term capital investment. Uncertainty is its own kind of tax.

On the fiscal side, 2025 also made the “mortgaging the future” tradeoff more visible. A major omnibus proposal, dubbed the “One Big Beautiful Bill Act,” was passed and is designed to stimulate short-term investment, but is estimated to add $2.4–$3 trillion to the federal budget over the next decade.

Meanwhile, the US debt-to-GDP ratio, currently around 120%, is expected to increase to 130% by 2030, against long-run growth expectations of 2%. This does not create an immediate crisis but does change the market’s posture. In this regime, investors increasingly demand to be paid for long duration, thus the anchoring of long rates at or near the 5% mark.

The most important macro “feeling” from late 2025 was the loosening of policy alongside continued growth, but with tangible signs of labor cooling. In the first nine months of the year, the economy grew at about 2.5% in inflation-adjusted terms, even as the number of jobs available to unemployed workers dipped below 1%. That tension is central to our 2026 framework because it helps explain why the Fed can ease monetary policy while long-term rates remain sticky. Short rates respond to labor and growth risks, while long rates increasingly care about supply, deficits, and credibility.

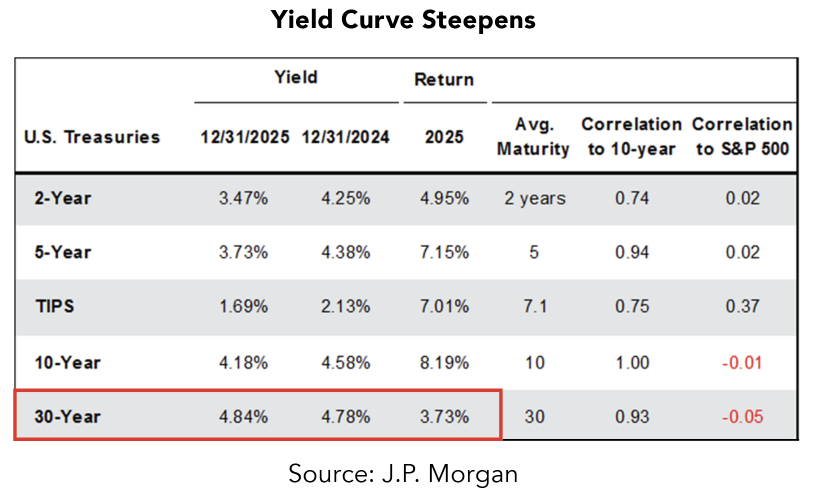

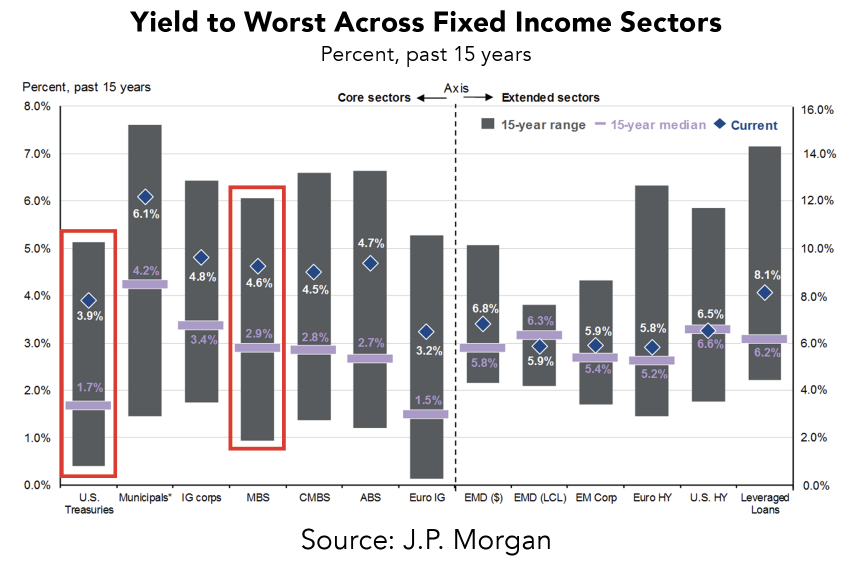

One of the clearest lessons of 2025 is that curve shape matters again. Issuance strategy, skewing supply toward the short end of the yield curve, can keep long rates stickier than expected even when the Fed cuts rates (which is why mortgage rates have not come down). The practical implication is simple: fixed income positioning should be built around liquidity, carry (borrowing at a lower rate and investing at a higher one), and the cost of taking on risk.

2025 LOOKBACK: WHAT WORKED, WHAT DIDN'T

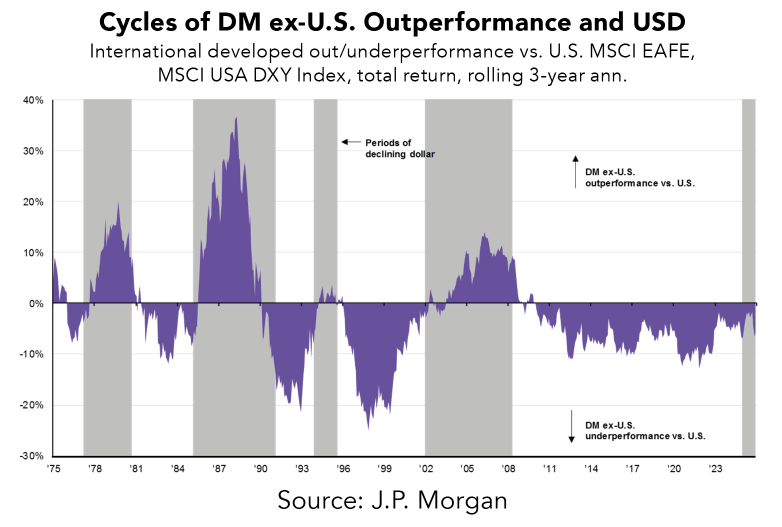

What worked in 2025 was owning portfolio features that benefit from dispersion. International diversification helped as currency outcomes became less unidirectional amid a slumping dollar.

In fixed income, structured carry mattered. Mortgage-backed securities were a clean way to earn income in a higher-for-longer environment, especially as the curve steepened (conditions discussed earlier).

Commodities, particularly gold and silver, earned their keep as diversifiers, supported by central bank demand. Recall that the team initiated a September position in a natural resources fund to take advantage of the cyclical nature of commodity price dislocations.

What didn’t work was assuming “normal.” The key theme driving these portfolio decisions was quality. Avoiding corporate credit (due to still tight spreads) and taking a more aggressive posture with respect to long rates yielded suboptimal results on the fixed income side. Our equity-quality overlay, initiated in late 2024, also underwhelmed as the market largely ignored valuation discipline. These risk factors remain heading into 2026.

2026 OUTLOOK: WHERE WE THINK THE MARKET OPENS UP

Our 2026 base case is not a “rates collapse” year, and we are fine with that. Fiscal thrust can support nominal growth while keeping risk premiums relevant. Equities do not require a perfect macro backdrop to broaden; they do, however, require an earnings backdrop that is supportive. That’s the opportunity.

First, we expect the market to price breadth increasingly. We alluded to the “S&P 493” framing earlier. This is simply shorthand for a healthier distribution of earnings growth. We are watching for that to show up in relative performance, particularly across mid- and small-cap stocks, where we are seeing improvement.

Second, AI is the mechanism that can make that breadth durable. The early phase rewarded the infrastructure layer. We expect the next phase of the AI buildout to reward adopters, those companies that can effectively embed AI into their workflows and convert it into measurable productivity. This is especially important in productivity-constrained sectors, where even modest efficiency gains can create meaningful operating leverage. When that shows up in margins and incremental returns on capital, multiples can expand for businesses historically priced as low-growth.

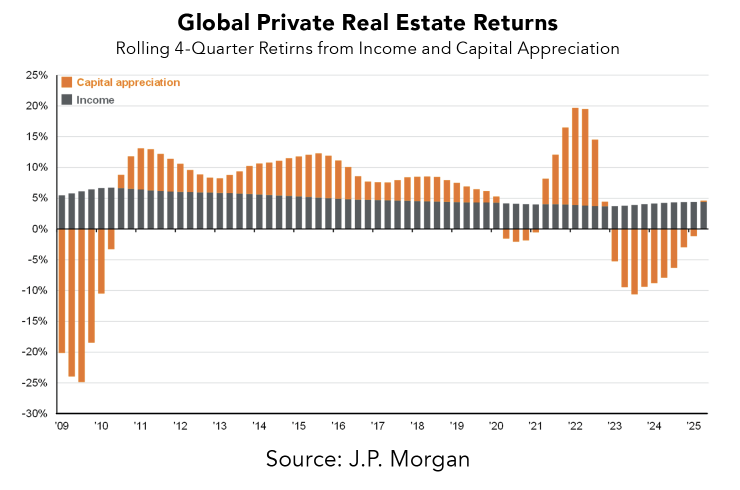

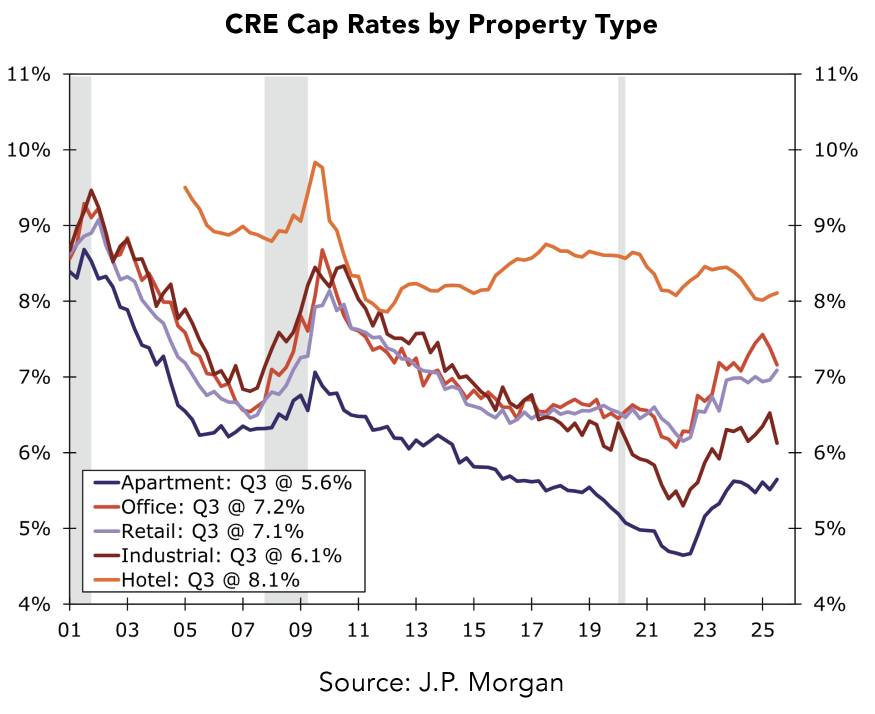

Third, real estate reenters the conversation, but with specificity. Office, retail, and industrial are not in the same place in the cycle, and dispersion here will matter. Still, as the headwinds to higher rates abate, real assets like real estate equity should again regain relevance. We plan to spend some time evaluating an equity Real Estate Investment Trust (REIT) for inclusion in our strategies as a value-add. Our opinion in this space is predicated on the idea that we see evidence of softening in shelter inflation that should act as a relief valve to consumer prices.

BOTTOM LINE CONCLUSIONS

The first quarter of 2026 is about moving from concentration to breadth and from narrative to proof. If 2025 was defined by fiscal dominance, 2026 has a reasonable path to being defined by productivity dominance, where the market starts paying for measurable efficiency gains, improving margins, and broader participation in earnings. This is the backdrop that sets up two follow-on stories we will develop this year: equity REITs as a strategic complement to equities and AI’s permeation into productivity-constrained sectors as the catalyst for multiple expansion.

As we enter 2026, the shift from rate-driven concentration to productivity-driven breadth may create new opportunities. Interested in learning more? Connect with a Midland Wealth Advisor today.

.jpg?sfvrsn=3df2d46f_3)