Summary:

After years of underperformance, public REITs enter 2026 with healthier balance sheets, cheap valuations, and stable cap rates, positioning the sector for potential recovery.

Want a broader view of this quarter’s trends? Download the full market outlook for insights across the economy, equity, and private markets.

Our Perspective:

Public REITs offer liquid, transparent access to real estate fundamentals with equity-like returns and income potential. Given the wide dispersion in valuations, we focus on security selection, prioritizing balance sheet strength and exposure to stabilizing sectors.

WHAT ARE REITS?

Real Estate Investment Trusts (REITs) are publicly traded vehicles that own and operate income-producing real estate. These structures trade intraday, offer equity-like returns, daily liquidity, and contractual cash flows associated with owning physical property. REITs distribute most of their taxable income to shareholders, which leads to total returns being influenced by property fundamentals and valuations.

Historically, REITs represented a large portion of an investor’s alternatives allocation. As access to private markets expanded, investors have diversified away from public REITs. This shift, and preference for growth-oriented equities, weighed on REIT performance in recent years. As measured by the FTSE Nareit Equity REITs Index (FNRE), the sector returned a cumulative 27.17% over the past three years, lagging the S&P 500’s 86.01% gain over the same period. In 2025, FNRE returned just 2.86%. This period of underperformance reset valuations to attractive levels relative to both historical norms and private real estate markets.

As rates peaked in 2024 and credit conditions began to stabilize, REITs responded by slowing development activity and proactively managing their liabilities. As a result, public REITs enter 2026 with cleaner balance sheets and reduced refinancing risk, supported by lower borrowing costs and improved leverage. This marks a transition away from multiple compression and toward stabilization in rates and cash flows.

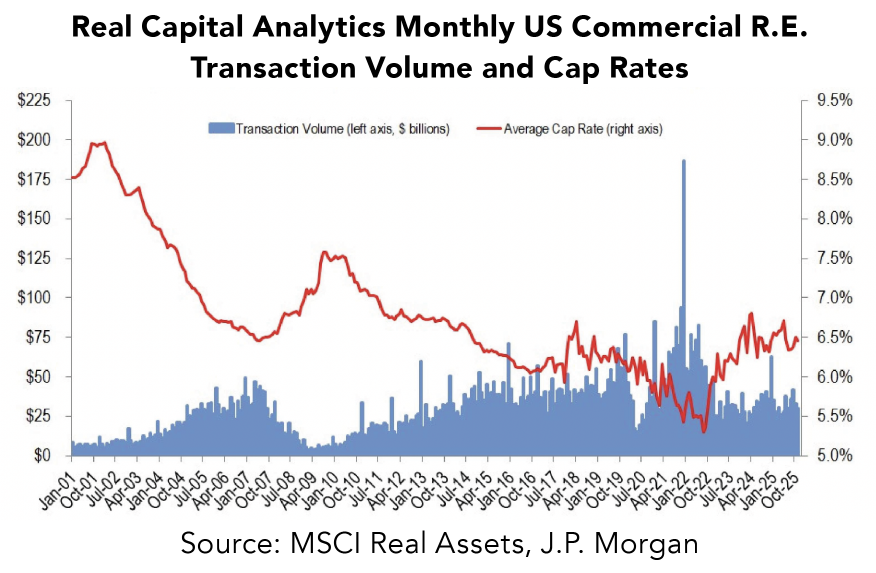

A key sign of this shift is the stabilization of capitalization (cap) rates, which reflect net operating income (NOI) relative to property value. The rise in interest rates in 2022–2023 drove cap rates higher, as the two move in tandem, pressuring real estate values and slowing activity. Cap rates have since largely stabilized across property types, a trend that historically precedes recoveries in transaction activity as valuation confidence improves.

Public REITs tend to respond to changes in cap rate expectations before private markets, as public pricing reflects forward-looking views versus completed transactions.

PROPERTY TYPES

Sector dispersion is increasingly important as performance across property types remains uneven. Healthcare performed strongly, supported by the highest NOI growth among property types in 2025. This should continue as the population aged 80+ is projected to reach 20 million by 2030. Retail REITs, particularly mall/outlet types, improved late in 2025 due to higher occupancy and renewed physical store demand. While sensitive to consumer health, strong lease demand supports a constructive outlook. Office real estate may be near a bottom after extended valuation compression and post-COVID occupancy issues. Although a recovery path exists, headwinds persist due to labor market uncertainty and potential AI disruptions.

CONCERNS FOR 2026

Competition for capital from private markets may lead to more REITs shifting from public to private. Lower expected earnings growth limits their ability to compete for capital where investor sentiment continues to favor higher-growth areas. A shift in sentiment away from this narrow set of higher-growth sectors could improve capital flows in public real estate, especially given current valuations.

Consensus forecasts show the 10-year Treasury yield remaining stable in 2026, with potential for modest increases. While small changes may have limited impact, larger shifts in rate expectations could materially affect performance. Current valuations and macro conditions appear supportive and may offer return potential in the coming quarters.

As markets evolve, so should your portfolio. Connect with a Midland Wealth Advisor to explore opportunities in innovation, diversification, and long-term growth.

Author

By Hunter Bukowy, Portfolio Implementation Analyst