Summary:

Private equity has transformed from asset-stripping tactics to long-term value creation, emphasizing operational improvement, strategic growth, and sustainable portfolio management.

Want a broader view of this quarter’s trends? Download the full market outlook for insights across the economy, equity, and private markets.

Our Perspective:

Private equity firms create value not through financial engineering, but by strengthening operations—driving efficiency, expanding margins, and building more resilient businesses that deliver sustainable, long-term returns for investors and stakeholders alike.

The Rise and Fall of the Barbarians

In our inaugural Private Markets article, we briefly debunked some of the misconceptions of what private equity firms do—primarily that they are chop shops that lever up companies, buy the whole, and sell the parts. It’s worth taking a closer look at how the private equity landscape has evolved—from one often viewed as aggressive to one increasingly focused on firm-level growth and value creation.

Private equity firms employed tactics that were often perceived as predatory throughout the late 1970s and into the 90s. Firms would set out to find undervalued firms where the whole was worth far less than the sum of its parts and utilize borrowing or leverage to buy out (LBO) the firm. From there, the firm would begin cutting costs and selling assets—whether by divesting business divisions, laying off workers, or liquidating the tangible assets. Private equity firms used these proceeds to pay down debt, thereby increasing the value of their investors’ equity positions.

Returns generated by the buyouts were not driven by the growth of the firm, but rather by financial engineering. Leverage often exceeded 80% of the deals, magnifying losses during downturns, but also providing massive upside for equity holders. One cautionary tale was KKR’s purchase of RJR Nabisco in 1989, where 80% of the buyout was financed with borrowed funds. The weight of the debt caused the firm to struggle with its cash flow, hindering its ability to grow. While KKR was eventually able to work through the investment, it took substantially longer and yielded returns below expectations.

As competition among private equity firms intensified and returns from traditional LBOs began to fade, the industry evolved. The new playbook emphasizes active management over financial engineering.

From Corporate Raiders to Value Creators

It is important to acknowledge that leverage is still a tactic employed today to generate returns. Buyouts are typically financed with a combination of 50% debt and 50% equity, although this ratio may vary at times. Likewise, asset stripping has not been completely eradicated from the toolbox of private equity firms and funds. It still occurs, but far less often.

One way to measure returns in private equity is by looking at the multiple on invested capital (MOIC), which indicates to investors the value created relative to the amount of capital invested. The two largest drivers of MOIC tend to be revenue growth and balancing out the price paid with the increase in the firm’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

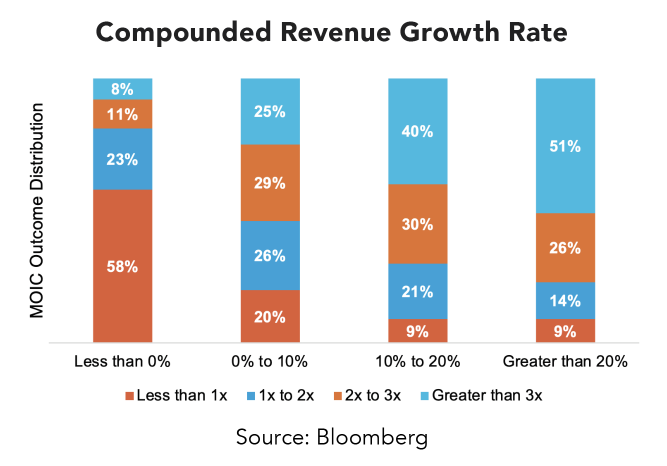

Firms that successfully grow their portfolio company revenues generally achieve higher multiples on invested capital. Between 2000 and 2020, 58% of portfolio companies that experienced zero growth had MOICs less than 1x—meaning their value fell below the original investment amount. In contrast, firms that successfully grew company revenues by 20% or more saw 51% of investments achieve multiples of 3x or higher.

40% of portfolio companies lost investment value if they experienced even a single year of negative revenue growth. In contrast, only 10% of firms have seen their valuations decline while achieving positive revenue growth. Simply put, topline growth is the engine of value creation and higher return multiples.

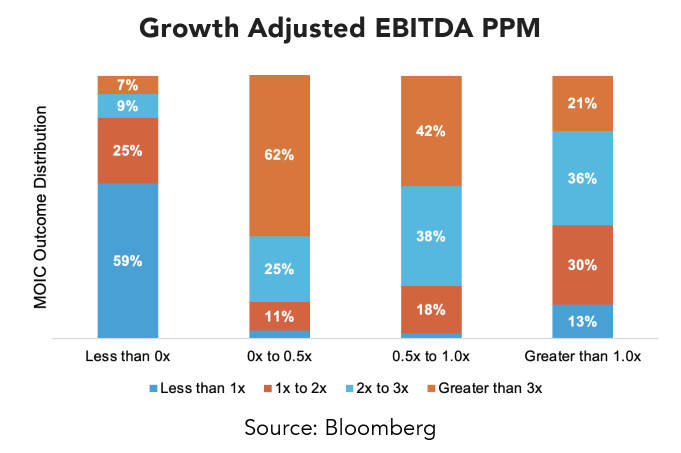

Private equity firms create value for investors by aligning the price they pay with the true growth potential of a company’s operating leverage, as measured by EBITDA. EBITDA growth is driven by two main levers: revenue expansion and margin improvement, the latter often achieved through cost optimization, supply chain efficiencies, and technology-driven productivity gains.

The strongest returns arise not simply from growing EBITDA, but from paying a fair price for genuine growth—nearly half of firms that maintained a purchase price-to-EBITDA growth ratio between 0x and 1x achieved returns exceeding 3x their original investment. By combining sector expertise with disciplined valuation, private equity firms identify and elevate businesses with real potential, driving sustainable performance and long-term value creation rather than overpaying for the illusion of growth.

Today’s private equity landscape looks far different from the era of corporate raiders and balance sheet engineers. As competition intensifies and financing costs remain higher, firms can no longer rely on leverage and asset stripping to drive returns. Instead, the success of the company depends more on an owner-operator mindset—one focused on sustainable value creation, operational efficiencies, and long-term growth. In this environment, the best private equity firms are not those who extract value, but those who build it.

Today’s private equity firms are focused on building value—not just extracting it. Connect with a Midland Wealth Advisor to explore how private markets may play a role in your portfolio.