Summary:

Rate cuts are still expected this year amid lingering inflation and gradually increasing unemployment data. Many developed countries have seen their debt-to-GDP ratios climb and are offering reasons to explore EM debt.

As interest rate uncertainty lingers and developed markets grapple with rising debt levels, fixed income investors are seeking ways to preserve yield, manage risk, and uncover global opportunity. This article explores why now may be the time to look beyond domestic bonds and consider international fixed income—particularly in emerging markets.

For deeper insights across equity, fixed income, and macro trends, read this quarter’s comprehensive market outlook.

Our Perspective:

The Federal Reserve (Fed) continues to debate the timing of its next move, which is widely expected to be a rate cut. Two 0.25% cuts by end-of-year are predicted.

Holding Steady for Now

The Federal Open Market Committee held rates in the range of 4.25-4.5% for the fourth consecutive meeting. The committee continues to allude to elevated uncertainty and data dependency in its rationale for the decision.

Fixed income, as measured by the Bloomberg Aggregate Bond Index, returned ~4% in the first half of the year. With current yields near multi-decade highs and the potential for rate declines if the Fed resumes cuts, the environment may be favorable for both income generation and capital appreciation.

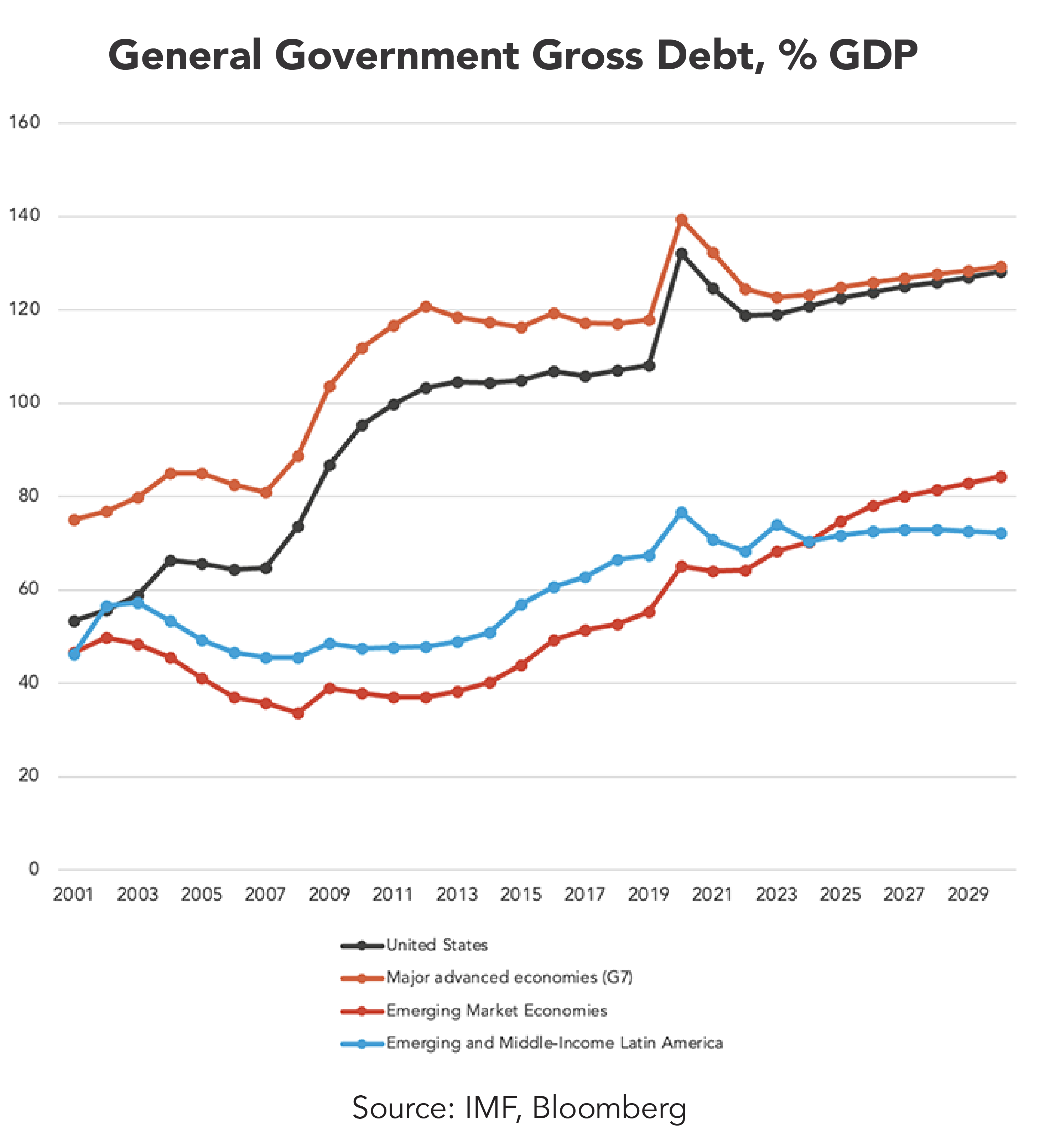

Perhaps a more interesting observation in the first half of the year has been the resilience of long-end rates in developed nations. It is relatively rare for central banks to cut overnight rates while rates at the long end of their sovereign curves rise simultaneously. Earlier commentary explored potential causes, but ballooning deficits in many developed market (DM) economies continue to weigh on economic growth.

The increasing costs of servicing this growing debt reduce spending on other productive investments. These rising debt levels are not sustainable long-term and will contribute to fiscal stress in DM economies.

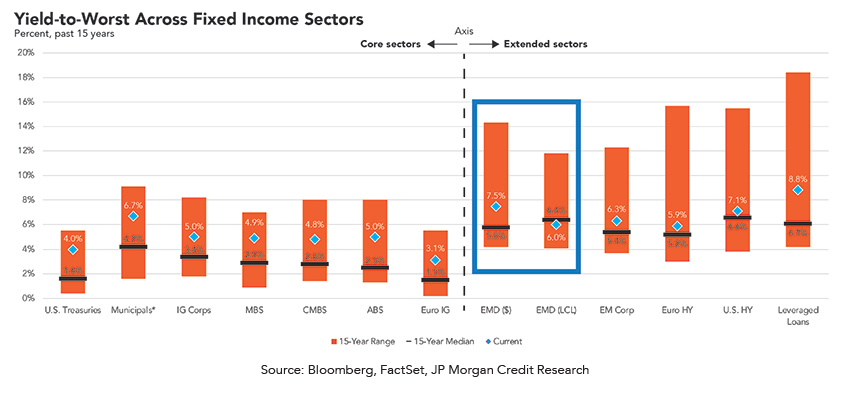

A complementary trend that our team has taken note of is the declining value of the US dollar. The US dollar has fallen more than 10% year-to-date—the steepest first-half decline since the early 1970s. Emerging markets (EM) are benefiting from this decline. Many EM countries borrow in US dollars. When the dollar weakens, this dollar-denominated debt becomes cheaper to repay by strengthening EM currencies (see chart, which displays both dollar-denominated and local currency-denominated EM debt yields). The weakening dollar also boosts commodity prices since they are typically priced in US dollars globally. EM economies that export commodities earn more revenue and improve trade balances when the dollar weakens.

An Appeal to Reason

Our investment team regularly discusses our equity and fixed income portfolios and the appropriate allocations within each. Key considerations within fixed income include credit, interest rate, liquidity, currency, and geopolitical risks. Equity diversification has historically included an allocation to international stocks, but what about fixed income? Fiscal risk in the domestic bond space could make yields go higher, which would cause prices to fall. Could international bond exposure offer an appealing area of diversification within fixed income? Let’s take a closer look.

Historically, EM debt has offered higher yields than DM debt due to perceived higher risks. This perception stems from political instability, currency volatility, and lower credit ratings. However, many EM economies now show strong fundamentals, such as lower government debt-to-GDP ratios and external net creditor statuses. The average government debt-to-GDP ratio in EM economies is 69.4%, compared to 126.5% in DM economies. These strong fundamentals reduce the likelihood of crises and enhance portfolio diversification benefits through low-to-moderate correlation with equities and DM bonds.

Example: Mexico’s Debt-to-GDP Overview

Current Level: Mexico’s gross government debt-to-GDP ratio is estimated at 50–55% as of 2024-2025. This includes both domestic and external debt.

Historical Context:

- Debt levels have remained relatively stable over the past decade, generally between 40% and 55%.

- Following the 2008 financial crisis, Mexico kept debt growth moderate compared to many other emerging markets.

- The COVID-19 pandemic led to a modest increase in debt, but Mexico avoided a sharp spike in borrowing.

Global Comparison:

- Mexico’s debt level is moderate for an emerging market—higher than countries like Chile or South Korea, but well below higher-debt peers such as Argentina or Brazil.

- For context, the US debt-to-GDP ratio is around 120%, while Japan’s exceeds 250%.

Credit Rating: Mexico generally holds an investment-grade credit rating (e.g., BBB/Baa2), reflecting moderate risk.

Portfolio Implications

Holding EM debt may provide an opportunity to earn attractive yields and diversify your portfolio. Portfolios may benefit from improving EM fundamentals, currency appreciation, and a supportive global economic backdrop. While risks remain—such as geopolitical tensions, inflation, and external shocks—the risk/reward profile looks compelling compared to many DM fixed income alternatives. It stands to reason that the more traditionally conservative elements of a typical investor’s portfolio may not be as conservative as once believed.

In today’s evolving environment, it may be time to rethink where conservative capital is allocated. While developed market debt has long been viewed as stable, fiscal stress and elevated debt levels are shifting that assumption. Emerging market debt, supported by improving fundamentals and favorable currency dynamics, offers potential yield and diversification advantages that could benefit investors in the current cycle.

Interested in learning more about how to align your fixed income strategy with today’s global trends? Connect with a Midland Wealth Advisor today.