Summary:

Markets surged to all-time highs in Q2 2025, led by growth stocks and policy-driven optimism, even as earnings expectations softened on margin pressure and global cost concerns.

Markets rallied impressively in Q2 2025, but the gains were uneven beneath the surface. With leadership concentrated in AI-heavy sectors and policy speculation influencing sentiment, this article explores the underlying trends that matter for investors: margin pressure, evolving earnings expectations, and the potential impact of new federal policy initiatives on sector performance.

For deeper insights across equity, fixed income, and macro trends, read this quarter’s comprehensive market outlook.

Our Perspective:

While investor sentiment improved meaningfully in Q2, gains remain narrow and concentrated. We believe upcoming policy initiatives, particularly the “One Big Beautiful Bill” (OBBB), could broaden market participation and support new growth initiatives. However, staying diversified is essential in a still-volatile macroeconomic landscape.

Sentiment Speaks

After a turbulent start to the second quarter, including a brief slide into bear market territory in April, US equities staged an impressive recovery. Major indices not only regained lost ground but finished the quarter at record highs.

The rally was fueled by a swift shift in sentiment, driven by renewed trade deal momentum, strong corporate earnings from Big Tech, and optimism surrounding the administration’s OBBB, a sweeping policy package focused on boosting defense, manufacturing, and infrastructure spending.

The Nasdaq 100 led the charge with an 18% gain, powered by strong performance in technology and communication services, sectors closely tied to the ongoing surge in artificial intelligence (AI) investment.

Technology topped all sectors with a ~23% gain, lifted by booming AI demand, particularly in semiconductors and data center infrastructure. Communication services followed with a ~13% increase, bolstered by similar AI-driven momentum and a recovery in digital advertising revenues.

Yet beyond the tech-heavy gains, performance across the broader market was uneven. The energy sector declined 8.5% amid heightened geopolitical instability, volatile oil prices, and regulatory uncertainty. Healthcare also lagged, falling ~7%, as rising medical costs, elevated utilization trends, and Medicaid-related policy ambiguity weighed on the sector.

Earnings Reset the Bar

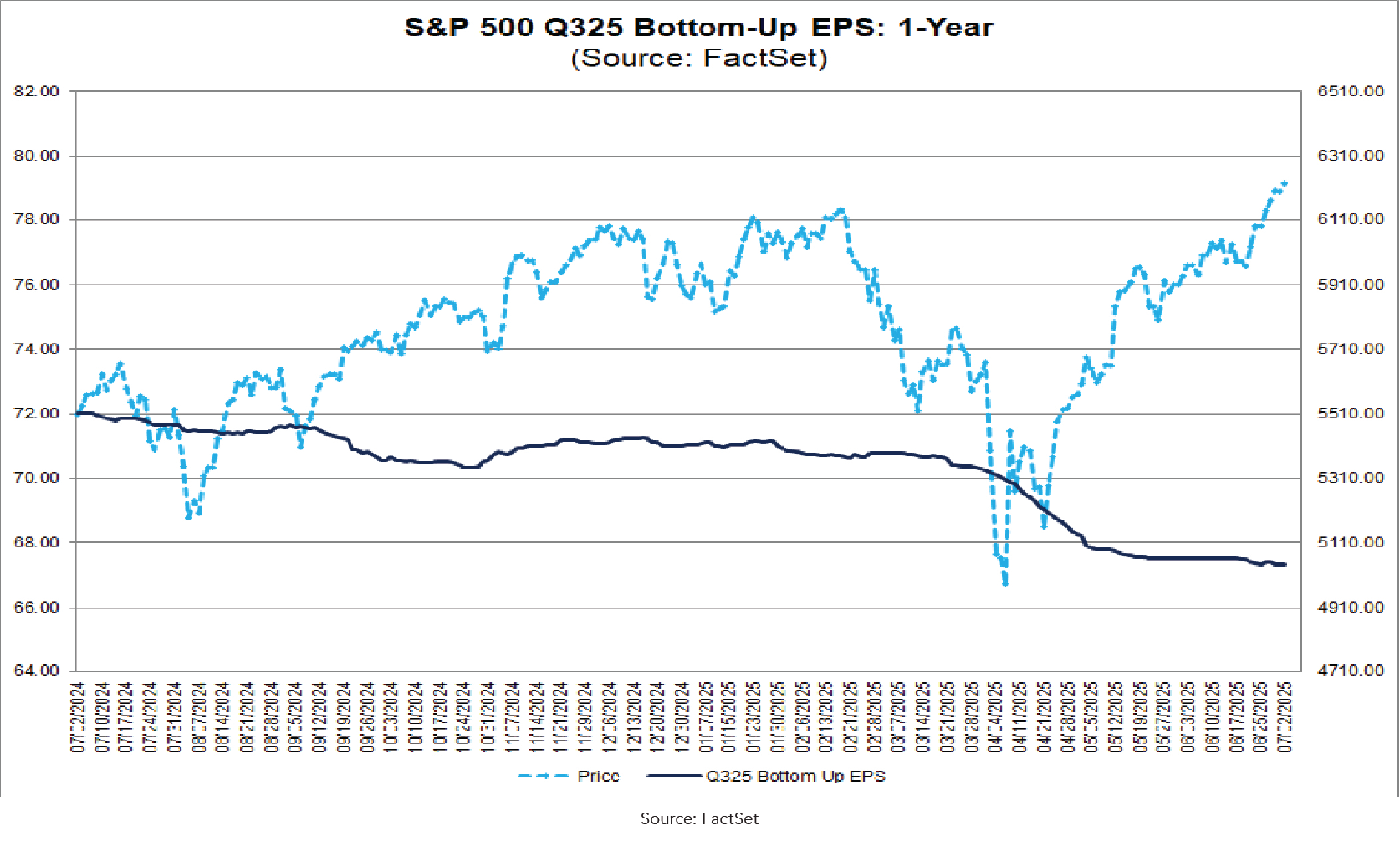

Despite the market’s strong performance, a notable shift occurred beneath the surface. At the start of Q2, analysts expected robust earnings growth of around 9% year over year. However, as the quarter progressed, rising tariff pressures, particularly on globally sourced goods, began to erode those expectations. As a result, the latest FactSet consensus now forecasts a more modest 5% year-over-year earnings growth rate.

While top-line revenue remains relatively resilient, companies increasingly feel the pinch on margins. Elevated input costs and renewed supply chain constraints are squeezing profitability, especially for multinationals with large international footprints. Still, lower expectations may create an opportunity for upside surprises, as markets have historically rewarded companies that exceed a modest bar.

As we transition into the second half of 2025, the OBBB could be a meaningful catalyst for market rotation and sector diversification. If implemented effectively, the bill may offer structural support to various industries, particularly those aligned with domestic investment, infrastructure, and innovation. We are witnessing some of these effects as analysts issue earnings growth estimates for the second half of 2025. These estimates are coming at ~11% relative to a decline of 4% in the first half of the year, equivalent to roughly 23% and -9% on a half-over-half annualized basis, respectively.

We see compelling opportunities in areas that combine value, defensiveness, and long-term structural growth. Financials stand to benefit from improving credit conditions and still-attractive valuations. Utilities and Real Estate offer defensiveness in a choppy market, with Real Estate especially poised to rebound if interest rates ease. Industrials and Materials, particularly US-based manufacturers, could enjoy a renewed tailwind from a stabilized tariff policy.

Meanwhile, Healthcare, despite facing recent headwinds, may reaccelerate as AI boosts the prospect of increases in productivity and innovation across care, delivery, diagnostics, and research.

Appropriations Could Deliver Value

The second quarter of 2025 highlighted how quickly market sentiment can rebound when policy support aligns with investor positioning. While headwinds from persistent but waning inflation, cost pressures, and narrow equity leadership remain, the groundwork is laid for broader participation and new growth drivers.

Discussing the overall impact of appropriation bills in the context of both bond and stock returns may appear somewhat contradictory. That’s intentional—macroeconomic data that supports corporate earnings growth may also weigh on debt market performance. In this evolving landscape, staying flexible, diversified, and focused on long-term objectives remains the most effective strategy.

Q2 2025 highlighted just how quickly markets can shift when optimism and policy align. While inflation and cost concerns persist—and equity leadership remains narrow—new opportunities are emerging. Broader participation may be on the horizon, especially as the “One Big Beautiful Bill” advances. In this climate, staying diversified, nimble, and long-term focused will be critical for navigating what comes next.

Curious how upcoming policy shifts and earnings expectations may shape your equity portfolio? Connect with a Midland Wealth Advisor today.