Market Outlook Newsletter

3rd Quarter 2022

By Betsy Pierson, CFA

Whether this question brings up good or bad memories, we have all been asked or have personally asked this question while attempting to reach a vacation destination. This will be a popular question in 2022 as consumers have stepped up spending on services and travel and left behind purchases of durable goods such as furniture, appliances, and even cars. Following the pandemic in 2020, consumers are ready to build new experiences after sitting at home for almost two years. Airlines are booked (and struggling to keep up), vacation rentals have minimal vacancies, and roadways are busy this summer. Looking at the rate of spending on services, it is difficult to imagine that our economy could be in a recession or moving towards one. However, will this discretionary spending continue after the glory days of summer have passed?

Speaking of recession, are we there yet? It is difficult to avoid hearing the R

word when you turn on the news, pick up a newspaper, or skim social media these days. Weekly Google search volumes for recession

in the United States have spiked in recent weeks. A well-known rapper even tweeted to her followers asking when it will be announced that we are going into a recession. There are signs that we may already be in a recession or that we will be in one by year end. The technical definition of a recession is two negative quarters of GDP growth. First quarter GDP was -1.6%, and the most recent estimate for the second quarter by the Atlanta Fed is trending negative. If this is the case, we have technically been in a recession for the first half of 2022. This is one way to measure a recession though. Another is The National Bureau of Economic Research (NBER) method. The NBER definition of a recession is a significant decline in economic activity that is spread across the economy and lasts more than a few months. Economic activity includes employment, personal income, industrial production, personal consumption, and retail sales. If you consider these factors, first quarter would not have been recessionary. The primary factors in the first quarter negative GDP were more imports (buying more goods) and a drawdown in inventories, which were both impacted by business and consumer spending. Employment remained strong and personal income increased. We do not believe we were in a recession during the first quarter due to these factors.

Looking at second quarter, there has been a slowing in our economic growth due to several factors. Inflation has hit the consumer directly through higher gas and food prices. While personal income has increased, real income after inflation has declined, which leaves less discretionary income for individuals to spend. In addition, financial conditions have tightened (less credit availability) with the Federal Reserve (Fed) starting its path to increase short-term interest rates and decrease its balance sheet. The cost to borrow increased especially in consumer loans and mortgages. The 30-year mortgage rate basically doubled from January to June (3% to 6%), making the average mortgage nationally cost approximately $800 more per month.

The primary goal of the Fed with these rate hikes is to clamp down on inflation by slowing demand, which could potentially put the economy into a recession. While recessions are not the desired outcome, we do need to get the supply/demand chain back in balance, and recessions achieve this to build a new base going forward. While we are still not certain that we are in a recession yet, we do believe the odds of going into one within the next 12 months have increased during the last quarter. The bigger questions are how long it will last and how severe (deep) it will be. We did have a recession in 2020 that lasted less than 3 months, but it was not caused by the typical business cycle. Instead, it was caused by the economic shutdown and the following unprecedented stimulus from both the Fed and the government. The U.S. has not experienced a business cycle (strong demand/short supply/FOMC tightening) like this since 2009. It has experienced a fairly stable economy for over 13 years. In many eyes, we are due for a business cycle reset.

While the Fed is attempting to achieve a soft landing (slow growth/lower inflation), it is walking a fine line, and it may be difficult to attain that goal. There has already been a 1.50% increase in short-term rates, and more are expected. Historically, it has taken three to six months to see the impact of rate increases on growth and inflation in the economy. The first increase was in March and looking at economic indicators in June, the U.S. is already experiencing slower growth, and inflationary pressures are subsiding. Manufacturing sentiment indicators have declined from the highs, consumer sentiment is at lows not seen since 1980, commodity prices have declined from the peak seen earlier this year, and real consumer spending has declined.

If we do enter a recession, we do not believe it will be deep and long-lasting. Unlike the recession caused by the Great Financial Crisis (leverage), consumers and businesses have strong balance sheets, and the financial industry is not highly leveraged with questionable credits and is well capitalized.

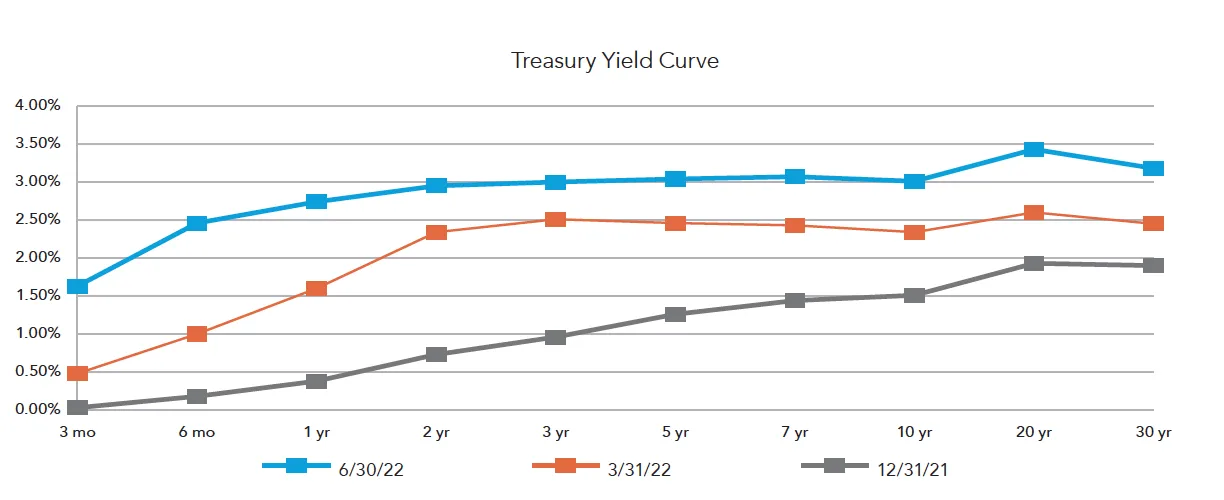

Since the beginning of the year, the bond market has begun to build in the Fed moves with the 10-year Treasury increasing from 1.5% to almost 3.5% and now settling back around 3%. This has led to the worst start of the year for treasuries since 1788. There was no place to hide on a total return basis. In turn, the stock market also declined in anticipation of higher inflation, a tightening monetary policy, and a slowing economy. Whether the worst is behind us is unknown, but on a valuation basis, the markets appear much more attractive today than at the beginning of the year.

To answer the question, Are we there yet?

we do not know. However, we do believe that long-term investors need to stay the course to meet both personal and financial goals. Determining the appropriate investment allocation is the long-term driver, and a diversified portfolio of bonds, stocks, and alternatives is appropriate.

The Fed has been on a path of raising interest rates since March 17, 2022. It started with a 25-basis point (bp) increase and has slowly dialed up the magnitude of increases, with a 50 bp increase in May and a 75 bp increase in June – the largest increase since 1994. On multiple occasions, Jerome Powell has stated that the Fed’s number one goal is to contain inflation, and it will not rule out the risk of recession. Currently, the Fed is poised to raise rates another 50 to 75 bp in July. The U.S. is not the only country dedicated to raising rates to fight inflation. The Bank of England (BoE) is meeting expectations with its 25 bp increases. Rising economic turmoil has made many investors fear the potential for a recession, that is if we are not already in one.

Credit spreads over the last quarter have started to widen. However, we are still far off from the spreads experienced in March 2020. Currently, credit spreads between Baa (investment-grade bonds) and U.S. Treasury securities have been hovering around 2.20%, compared to the 4.33% we saw in 2020. Also, the U.S. Treasury spreads are less than 80 bp compared to the 2.48% from 2020. While spreads continue to widen, real interest rates to nominal interest rates have begun to narrow, however, only marginally. Real interest rates bottomed out at -7.63% and are currently closer to -5.75%. Nevertheless, as rates continue to rise and inflation stabilizes, we should start to see real interest rates improve.

There have been moments over the last quarter when the 2- and 10-year yield curves have inverted, albeit temporarily. The spread between the two has been less than 20 bp since the last inversion on June 12, 2022. The 2-year has been on the rise since the beginning of second quarter. It started with a yield of 2.44% and peaked mid-June at 3.45%. We are now around a low 3%. The 10-year Treasury is currently at 3% as well, down from its peak of 3.49%. That being said, the 3, 5, and 7-year Treasuries are now yielding more than the 10-year. Given recession fears and the small spread between 2- and 10-year Treasuries, we want to reiterate that an inverted yield curve is only one tool for predicting a recession. While the historical connection between the two is prevalent, recession risk should be taken in the entire context of the economy, not just one indicator. We need to see the confluence.

Interestingly, with treasury prices on the rise and yields falling, investors seem to be anticipating more of a recessionary environment as opposed to inflationary. With the Atlanta Fed’s announcement of a negative second quarter GDP estimate, it seems investors are on to something. The expected fed funds rate, which measures the expected fed funds rate in 18 months minus the expected funds rate in 6 months, is now negative into 2023. This means the market is expecting the Fed to cut rates by mid-2023. There is a potential for a low interest rate environment again.

Taking into account all of the above, our investment team is making some tactical modifications to our fixed income portfolio. With more pressure to potentially slow the pace at which the Fed is increasing rates, we have decided to close the duration gap between our portfolios and the benchmark. Our prior allocation called for a 20% duration short, but now moved to be 10% short. Given that consumer sentiment is near record 16-month lows, we have also added a 10% allocation to treasury bonds. A flight to safety may have many people looking to invest at the risk-free rate. We also decreased our ultrashort position by 10%. We believe that the bond market has priced in most of the interest rate increases and that it is a good time to lengthen our duration to boost portfolio yields.

By Tracey Garst

As the second quarter draws to an end, the headlines read Financial Markets Suffer Their Worst First-Half Performance Since 1970.

Even those of us who began our careers in the mid-1980s need to go to the history books to put this into perspective. Stocks have officially entered a bear market, which is commonly defined as being down more than 20%. Investors have largely priced in a significant slowdown, if not a recession. Risks concerning the war in Ukraine, Covid-related shutdowns in China, and sticky inflation across the world will make economic growth more challenging given higher consumer costs and tighter Fed policy.

Whether we are in a recession or if we will even have a recession is anyone’s guess. If we do have a recession, how severe will it be? Nobody knows this answer, however, there are plenty of talking heads

out there taking both sides of the discussion. The stock market is not the economy. Since 1947, the U.S. economy has endured 12 economic recessions and seen 12 equity bear markets. The average recession has lasted for 10 months, while the average expansion has lasted for over five years. Historically, stocks peak before a recession, and they begin to recover well before the government data declares an end to a recession. Trying to time investments around a recession is not an easy task.

Unlike the pandemic-induced bear market in 2020, the only cure for this bear market is time. During the pandemic, the Fed and the U.S. government came to the rescue and flooded the economy with liquidity, which set the stage for much of the inflation we are experiencing today. While bear markets are unpleasant, they do serve a purpose; they help work off the excesses that have built up since the previous recession. In this case, those recessions are the 2008-2009 Global Financial Crisis and the 2020 Pandemic. These excesses include but are not limited to, easy monetary policy, near zero interest rates, excess liquidity, cheap money, and excess speculation (meme stocks, stay-at-home stocks, EV-related stocks, SPACs, cryptocurrency, etc.).

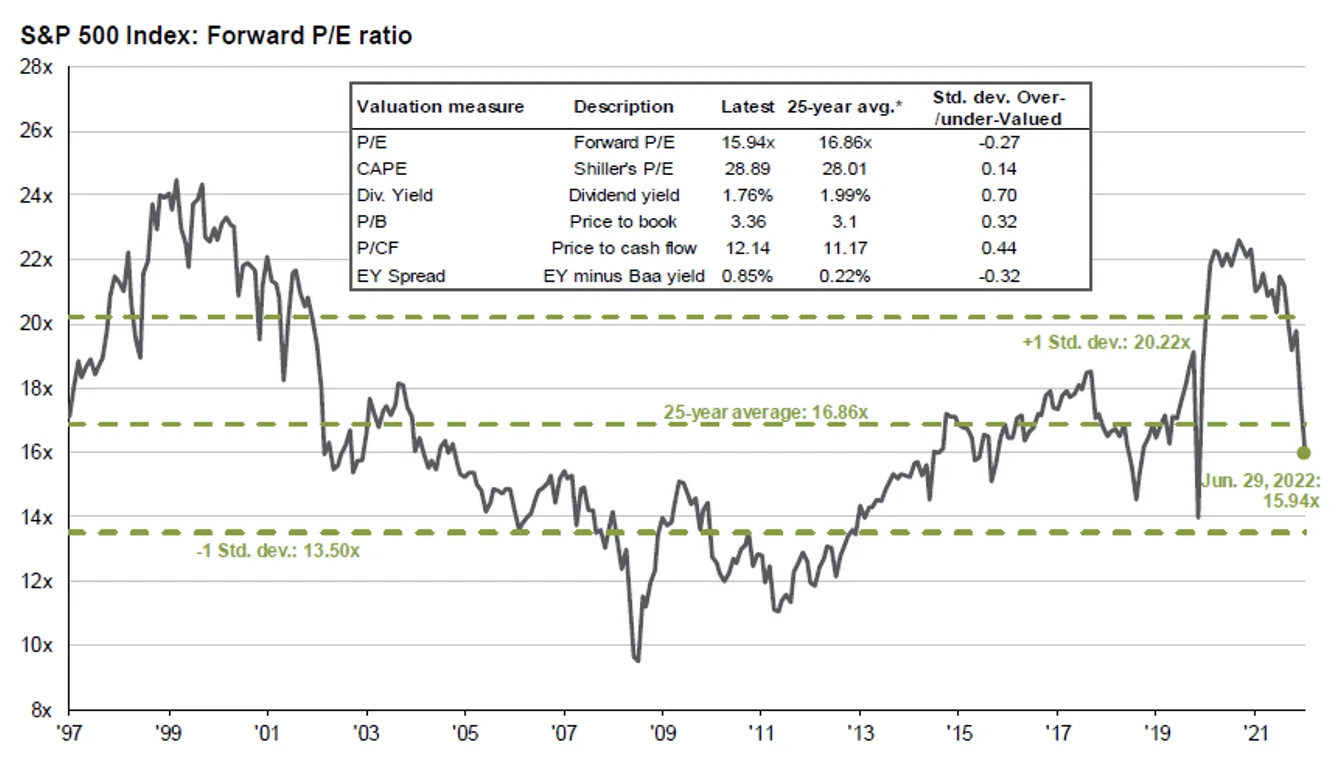

In the long run, stock valuations and fundamentals matter. We are amid a repricing of global stock market valuations to better reflect current fundamentals. We believe this is positive and is creating an opportunity for longer-term equity investors. While this year has been painful for all investors, the S&P 500 Index is now trading at a forward P/E ratio of 16x, which is below the 25-year average. This is not to say that stocks could not go lower. However, on a historical basis, valuations are much more reasonable today. We are heading into second quarter earnings season, which will be extremely important for the stock market. Currently, corporate earnings are expected to grow by about 8%, which is still a solid earnings growth rate. We are expecting some deceleration in earnings growth, but we do not expect an earnings recession like we had in the 2020 pandemic.

Apart from cash and energy stocks, there has been nowhere to hide within the stock or bond markets this year. As of this writing, the DJIA is down 14%, the S&P 500 is down 19%, the Nasdaq is down 28%, small-cap stocks are down 23%, and international stocks are down 18%. Based on several technical indicators that we follow, stocks were significantly oversold, which could set the markets up for a nice rally in the second half of the year. Consumer sentiment is at the lowest levels we have seen since 1980, which tends to be a contrarian indicator. If history is any guide, this extreme bearish sentiment could lead to a period of outperformance for equities.

For a second-half rally to take place, we will need corporate earnings to hold up and the Fed to pivot to a less hawkish outlook. With commodities selling off and beginning to roll over, this might work in the Fed’s favor as we head into the second half of the year and mid-term elections. Interestingly, since 1962, the average drawdown of the S&P 500 during mid-term election (non-Presidential) years has been 19%. This is comparable to where the markets are today. More important is the fact that stocks have performed well during the year following these mid-term elections.

As we enter the second half of this uncertain year, we are currently neutral weighted to stocks. At a current forward P/E multiple of 16x, we continue to find stocks more attractive than bonds. Our current overweight is to international stocks, which trade at a 12x P/E multiple and have outperformed the U.S. markets thus far in 2022. Early in the year, we reduced our growth exposure and added to value, which turned out to be a good tactical move. As the economy slows, we may consider adding back to growth. However, we feel it is premature to make that decision at this time, but it is on our radar.

One of the most common questions we hear from clients is, Do I need a Trust?

While I like giving neat-and-tidy answers, this is not one of those questions where that can be done. Every person’s estate is a little bit different, and this requires individual analysis before determining if a trust is right for you. My goal in this article is to help you in this analysis, so that we can answer this question for you.

A good starting point is to understand what exactly a trust is and what it does. When you know the purpose of a trust, you are better able to evaluate if this is a legal document that would benefit you.

A trust (sometimes called a revocable trust

or a living trust

– but what I will simply call a trust

in this article) is sometimes referred to as a Will Substitute

because a trust mimics a Last Will and Testament: it provides us with instructions for what to do with the trust assets at the time of your death. The trust designates someone in charge of this whole process: we call this person the trustee

(by way of reference, the person in charge of a Will is called an executor

).

So why would someone desire to have this Will Substitute

? Why not just have a Will? The primary reason is that Wills can be much more expensive and time-consuming to administer than a trust. In order for an executor to be able to carry out the terms of your Will when you die, they must be court-appointed by a probate judge. The executor lacks the legal authority to pay bills, sell assets, and make distributions without this court appointment. Not so with the trustee. A trustee can handle the administration of your affairs without needing a probate court appointment. Avoiding probate court is often desirable because court almost always means more money (legal fees), time, and publicity are spent administering your estate. While it is true that the creator of the trust does not realize these benefits, the people they love most will, and this is a significant incentive to implement a trust.

But now we could swing the other way – why would you NOT create a trust? Doesn’t it always make sense to avoid probate court and provide our loved ones with more money, time, and privacy?

There are two main reasons a trust is not right for everyone. The first is this: a trust is not the only way to avoid probate at the time of your death. For example, assets held in joint tenancy with someone else or assets with a beneficiary designated on them will avoid probate when you die. If the bulk of the assets you own are already jointly-held or have a beneficiary designated on them, then these assets are not subject to the distribution instructions of your Will and will not be subject to the probate process when you die. Having a trust in this situation could be superfluous – the document may not add value as a probate-avoidance tool. This being said, trusts are often the best probate-avoidance tool in a number of situations: (i) you own real estate in another state, (ii) you own a small business; (iii) you have a blended family; (iv) you have a special-needs beneficiary; or (v) your beneficiaries do not get along.

A second reason why not everyone may choose to have a trust is that the implementation of a trust is typically more work (and costs more money) than implementing a Will. This is because a trust needs to be funded. That is, the distribution instructions in the trust are only valid over assets that are titled in the name of the trust. Having the trust document prepared and signed is only a first step; you must then retitle assets into the trust for that document to be able to govern those assets. This retitling process takes additional work (both on your part and your attorney’s part), which is why trusts typically cost more to implement. And this retitling process is ongoing: as you acquire new assets, you must evaluate if it is appropriate to title this new asset into your trust.

Like most things in life, I wish there was an easier answer to the question of Do I Need a Trust?

Each person’s situation in life is different and should be evaluated on a case-by-case basis. A prudent approach to the answer will mean careful evaluation of your particular circumstances and estate planning goals.

The trust is a wonderful tool (and not just for probate avoidance), and many of our clients have them. But this does not mean you should bypass the work of evaluating if it is rightfor you. We would love to talk with you about this if you have additional questions and see if your situation is one that could benefit from implementing a trust.

Our team of dedicated professionals are here to support you.