How Can We Help?

Personal Banking >>

Achieve your financial goals with the personal service you deserve and the technology you need.

Commercial Banking >>

Build the financial foundation of your business with a Midland operating account.

Wealth Management >>

Financial peace of mind is a conversation away. Let’s connect and take your financial plans to the next level.

Small Business Banking

Partner with a world-class team of relationship managers and a suite of products designed to move your business forward.

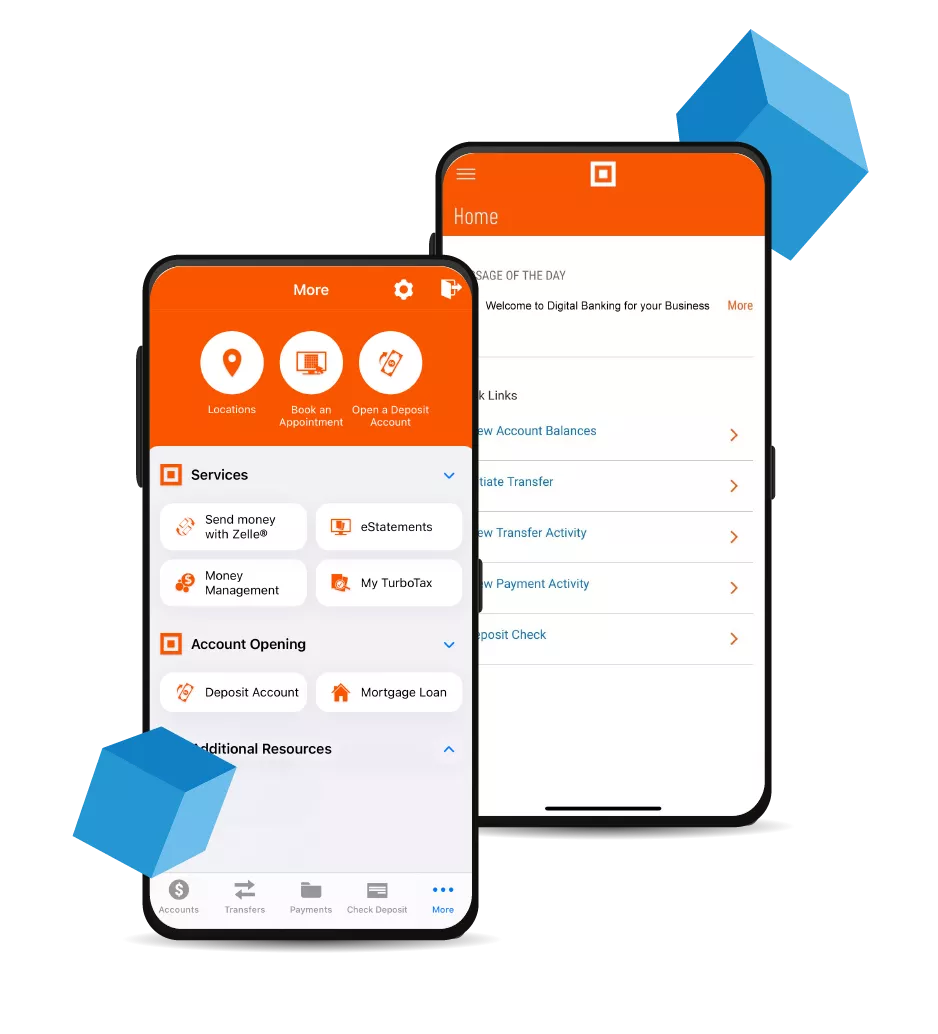

Banking in the Palm of Your Hand

Midland Online & Mobile Features:

- Mobile Wallet

- Mobile Check Deposit

- Money Management Tool

- Smartwatch Banking

- Alexa Voice Banking and more!

Ready For Better Banking?

Open An Account Online

Visit a Nearby Branch

Who We Are

A Little About Us

Established in 1881, we are a strong and growing diversified financial services company, we take heart in providing our clients with world-class service, our shareholders with ownership in a prosperous company, and our employees with a fulfilling career where they can advance.