Ready, Set, Go!

You don’t realize to what extent humans need personal interaction until you have been deprived of it and suddenly it is at your doorstep again. As the economy has reopened and face-to-face interaction has increased, it certainly has been wonderful to see the optimism and positive exchanges between individuals. This has also carried over to the economic environment. Pent-up demand for social interaction and travel is driving the services area of the economy with strong airline and hotel bookings. Growth in the 1st quarter exceeded 6% annualized, and we wouldn’t be surprised to see a similar, if not higher, level in the 2nd quarter. The economy is firing on all cylinders with demand from both consumers and businesses.

One of the challenges in this economic recovery for businesses is the ability to fill open positions. Everywhere you go, there are Help Wanted signs with promises of signing bonuses and higher wages than previously offered. There is a belief by many that the extra unemployment benefits are the reason for the worker shortage but in reality, there is more to it. Yes, the extra benefits could be part of the problem, and several states have recently ended the federal subsidy to the unemployed. The impact on employment numbers should show up in new jobs created in July and August. The real impact will be seen after the federal subsidy ends on September 6, and the extra funds are no longer being received in any state. There are several other reasons for the shortage of workers, too, including lower immigration over the last 18 months. With closed economies and limited international travel, the number of immigrants declined dramatically from a little over 1 million per year to less than 250,000 in 2020, leading to a shortage of available workers. Our economy is dependent on immigration to continue growth in the working population, and the decline in ‘new’ workers certainly has impacted the current employment picture. In addition, there has been a substantial number of people deciding to retire and not return to the workforce following the pandemic. The strong markets and increased asset values have allowed individuals to step back, review goals and determine that the option to retire is available to them. During the pandemic, individuals have also relocated to different areas of the country. As we have reopened, there are fewer job seekers in areas where there are rising employment opportunities. While many careers can work remotely, manufacturing, hotels, restaurants and basic service industries cannot offer that as an option, leading to the shortage of workers in certain markets.

While the Federal Reserve (Fed) believes that the increase in inflation is transitory, there is a risk that the shortage of employees will lead to wage inflation. There are many reasons to believe it may just be transitory and will level off to the 2% range targeted on a long-term basis by the Federal Open Market Committee (FOMC). A year ago, the inflation rate was flat, and as discussed previously, inflation year-over-year will be high through the summer. Lumber prices have already declined, shortages of semi-conductor chips will be worked through in the next 6 to 12 months leveling off those prices, and the shortages of many products will become less problematic. The canary in the coal mine regarding inflation is the wage pressure. Companies are beginning to increase wages to attract employees, which increases costs. These are not temporary increases but long-term increases. Will companies be able to pass on these increased costs leading to higher prices on services and products? If so, inflation may run higher than expected over the next year. With travel and international borders reopening and the end of the supplemental federal unemployment benefit, this may work itself out with more available workers. The markets will continue to monitor this and will respond accordingly. The risk to the markets and economy 12 to 24 months out, which at this time is minimal, is that the FOMC doesn’t react quickly enough by pulling back the excessive accommodative stance, causing the need to swing the pendulum the other direction, which typically leads to a slowing economy.

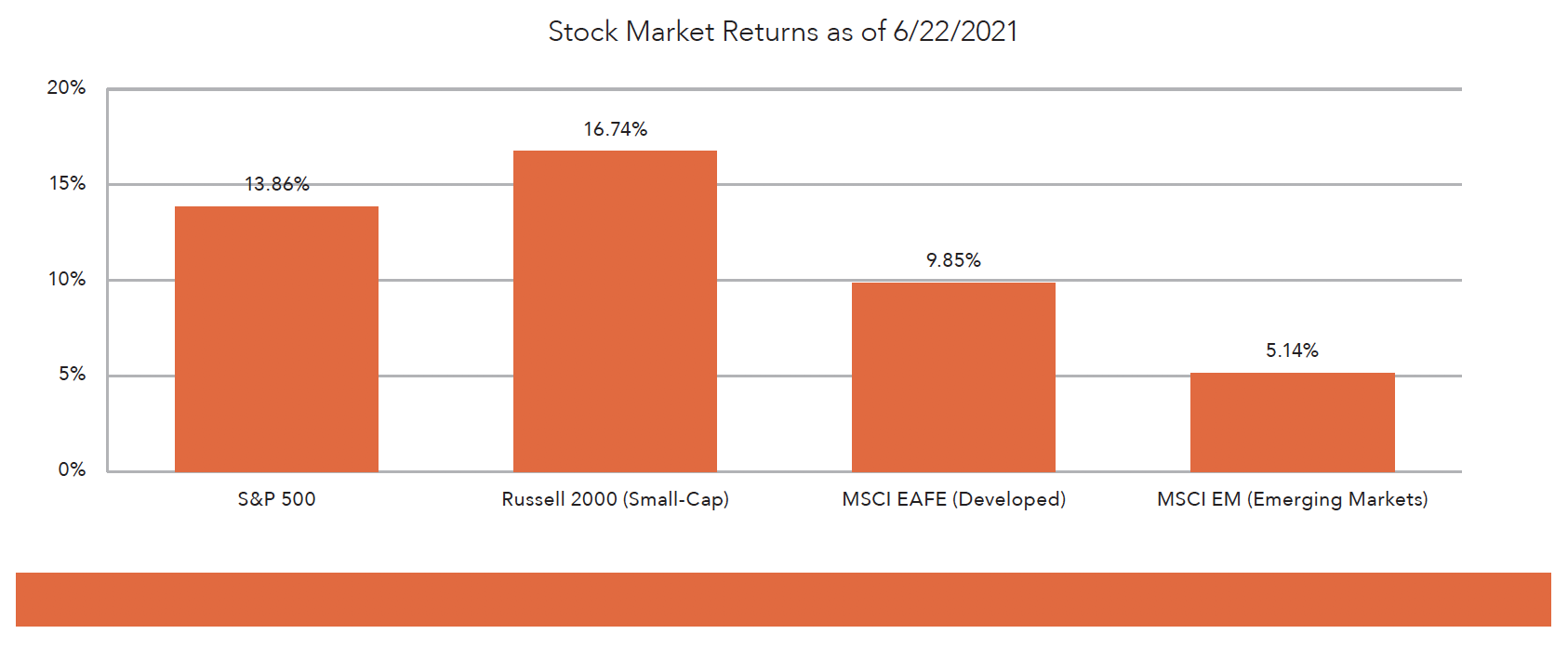

Until we see the full impact of the labor shortage, we continue to believe the global economy will continue to expand and provide investment opportunities. The past 12 months have provided strong returns for investors, and we would anticipate lower returns over the next year. While we may have lower returns, the extremely accommodative monetary policy across the globe, the excess liquidity and continued low interest rates provide a favorable backdrop for equity markets. Considering this outlook, we continue to have an overweight position to equities along with a slight underweight to fixed income.