Good Riddance 2022, Welcome 2023?

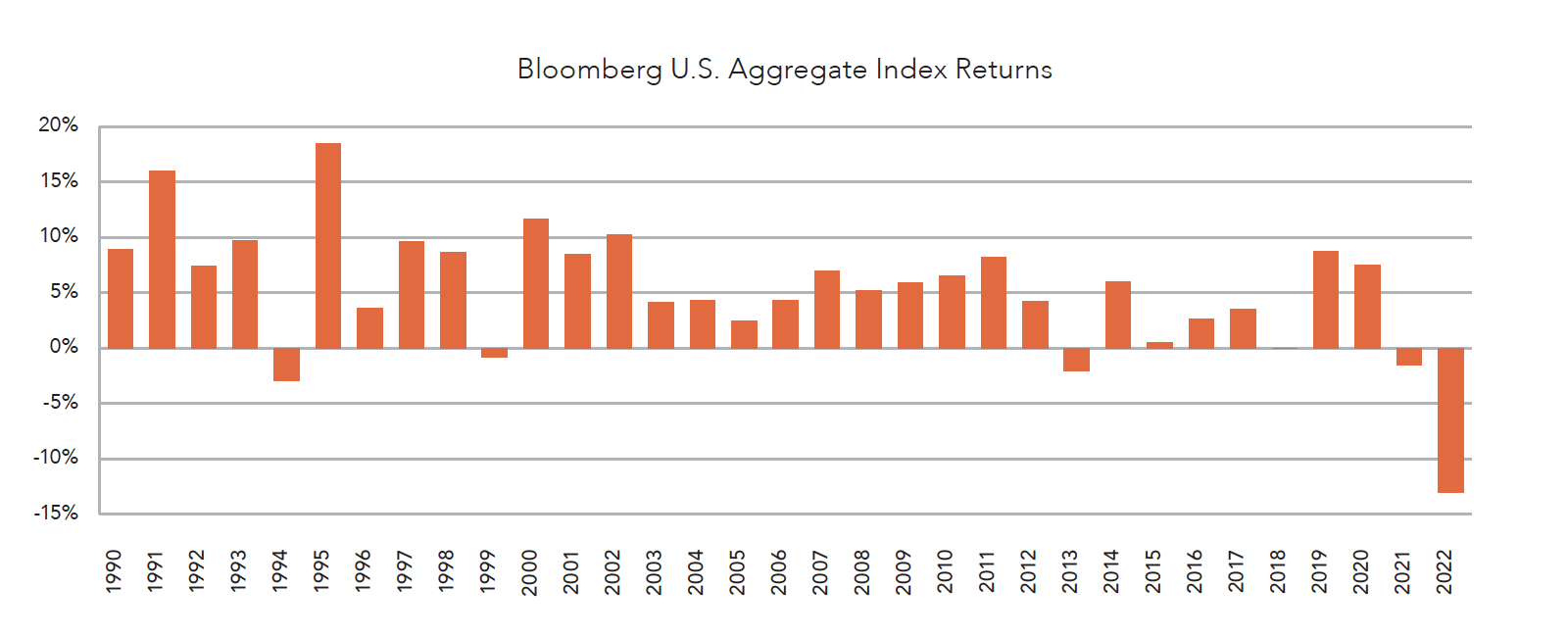

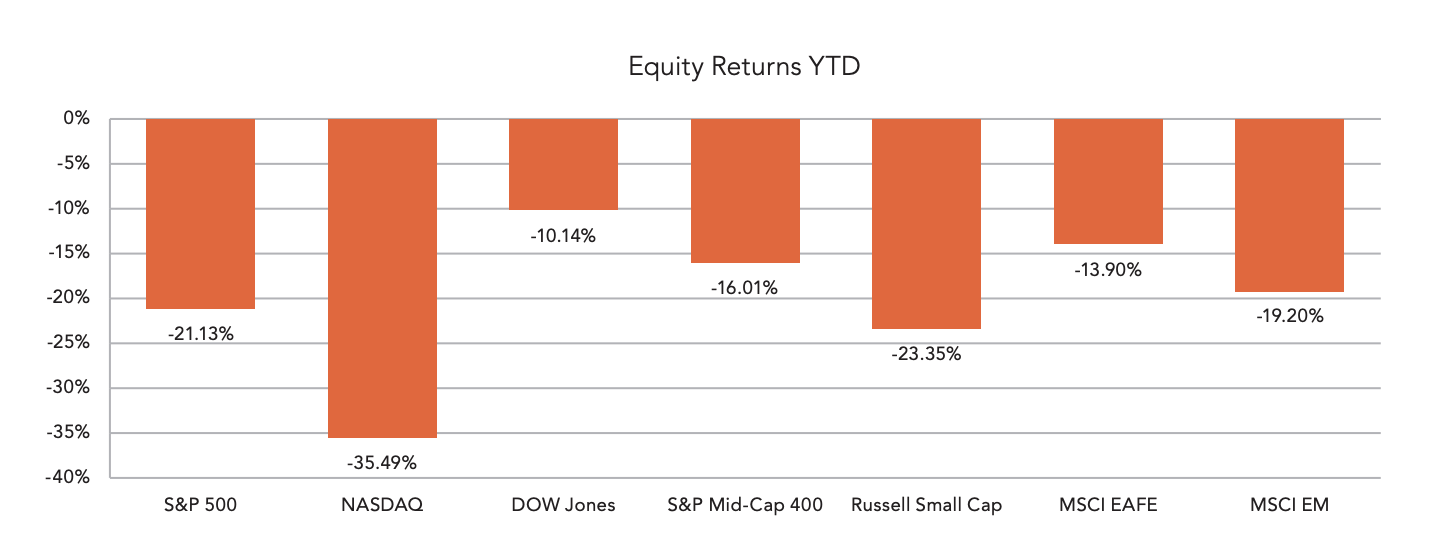

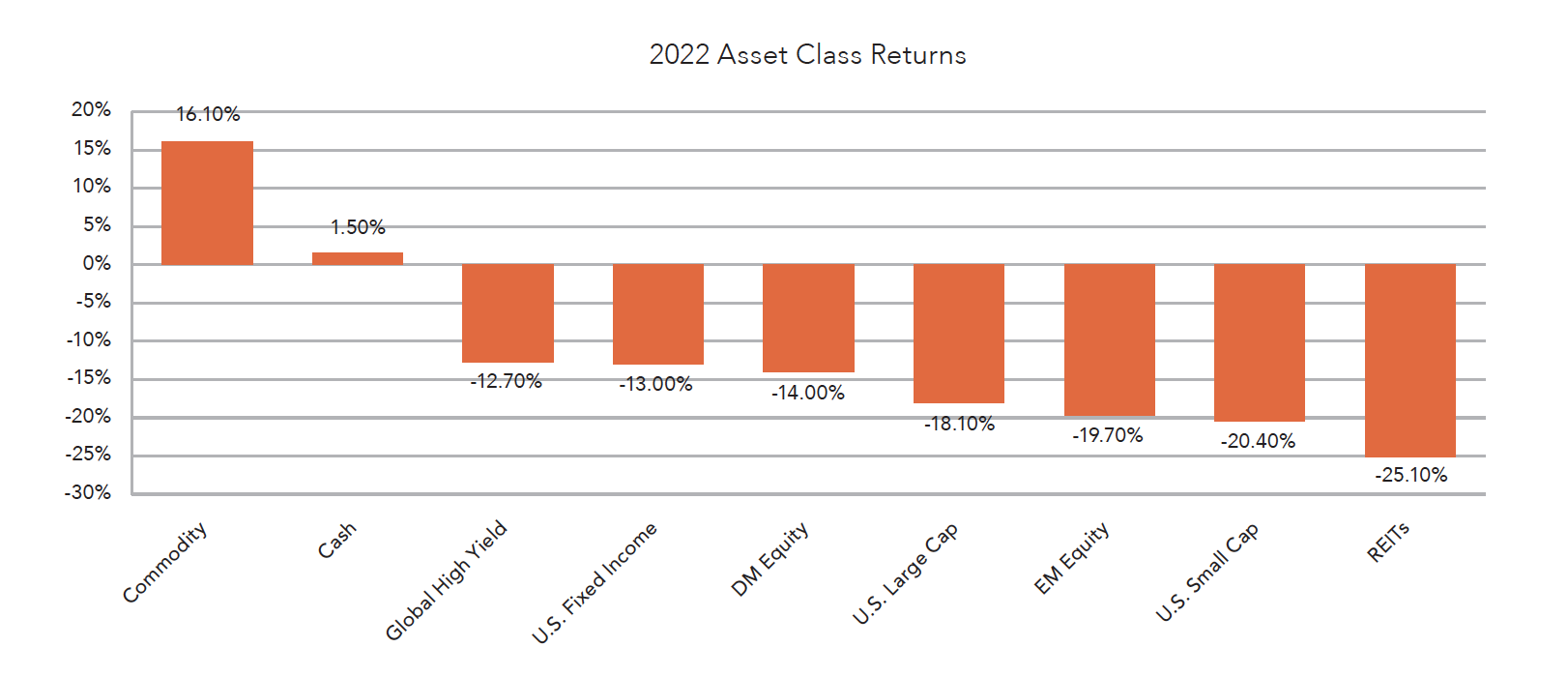

This last year has certainly been a challenging one for investors. There were few places to hide unless you were invested in commodities or cash. 2022 will go down in history as one of the worst years for the 60% equity/40% bond investor with double-digit negative returns. The S&P 500 index return was the lowest since 2008 and bond returns, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, were the lowest since its inception in 1976. Moving from a zero-interest policy to an aggressive rate-hiking cycle weighed heavily on fixed income returns and bled over into the equity markets.

Is the 60/40 portfolio dead?

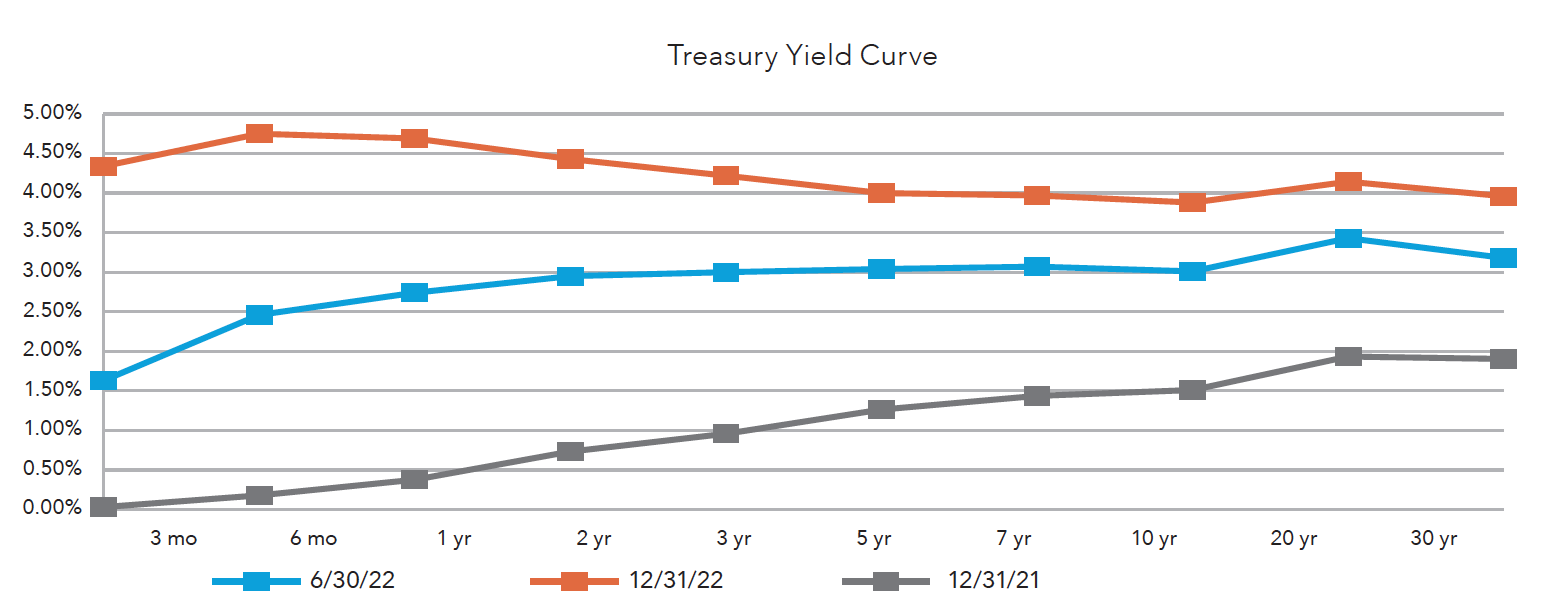

One year does not make a trend, especially considering that interest rates are now back to levels we have not seen in a decade. Over the last year, the dramatic increase in rates led to lower prices on bonds with no income to offset the price movement, which resulted in a negative total return. The yields now available on bonds can protect on the downside where they could not in 2022, assuming interest rates increase gradually. Also, while the Federal Reserve (Fed) is still leaning towards more interest rate hikes, it is 85% to 90% complete barring any dramatic increases in the inflation rate. Looking at it from this viewpoint, if interest rates remain stable, the fixed income component in the 60/40 portfolio should provide an estimated return of 4%*. This will vary depending on the direction of interest rates, but we do not anticipate negative fixed income returns in 2023. Regarding the equity portion of the portfolio, there may still be pressure on returns during 2023 as we move through this Fed tightening cycle and the business cycle. However, historically since 1926, equities have returned 10% on average. While many pundits do not believe that this will play out in the future, if you look at the average annual return of the S&P 500 over the last 3-year, 5-year, 10-year, and even 30-year period, the return is close to 10% annually despite the market ups and downs.

Inflation has been so high in 2022, and the Fed has responded aggressively. Will inflation fall closer to the Fed’s target rate?

All inflation numbers indicate that it peaked sometime during summer. The Consumer Price Index (CPI) peaked at 9.1% year over year in June and declined to 7.1% year over year in November. The Core CPI (excluding food and energy) peaked in September at 6.6% year over year and most recently was at 6% year over year. While the numbers are nowhere near the Fed’s 2% target rate, the trend is moving in the right direction. If you look at CPI annualized in the last 3 months, the rate is less than 4%, and there has been little inflation since it spiked in May and June. As mentioned in our last outlook, money supply growth has declined dramatically and was negative in the most recent release. Money supply growth leads inflation by about 18 months and has been declining rapidly since its peak in 2021. Inflation is following according to the norm and has rolled over on cue. If this trend continues, the inflation rate will be close to the Fed target within the next six to nine months. Of course, this does not mean that prices will decline from current levels but will not increase substantially more. If this follows course, the Fed will slow down or even pause the tightening cycle by mid-2023, if not earlier.

With the aggressive Fed moves in 2022, will there be a recession in 2023 or will a soft landing be achieved?

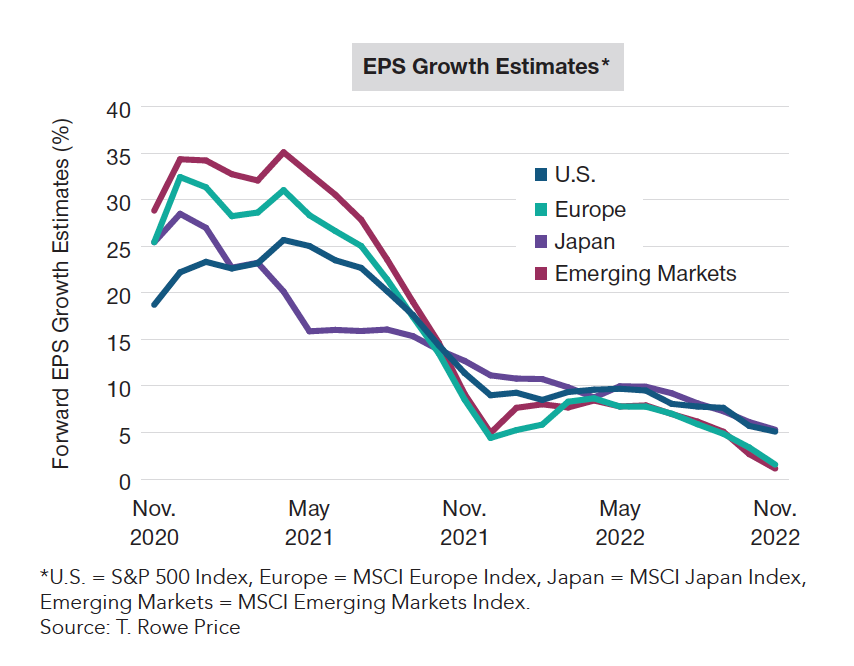

Whether there is a soft landing or a recession, economic growth will be slower than in the last two quarters of 2022. The second half of 2022 grew at greater than a 2% annualized rate. Several economic and market indicators lead us to believe there will be a recessionary period sometime in mid-2023. The inverted yield curve, including but not limited to the 3-month to 10-year Treasury, became inverted in mid-October and continues to maintain that position. The leading economic indicators have been negative for the last nine months and over the last 60 years, which have historically led to a recessionary period. While no indicator is 100% accurate in predicting a recession, there are many signs that the U.S. will enter a recession sometime in the next six months. Economic activity has slowed, especially in the housing market. Higher interest rates have made homes less affordable due to the higher monthly mortgage payments. While many of us remember rates at 6% levels, there is a whole generation that has not experienced mortgage rates above 5%. In addition to homes being less affordable, current homeowners with 2.5% mortgage rates are hesitant to sell and move up to a 6% or higher mortgage. As a result, home prices are declining in many markets, which was one of the Fed’s goals with the aggressive rate hikes. The labor market continues to be one area that has not shown strong signs of easing, but the labor market is a lagging indicator and is typically the last to fall. Regarding the labor market, there continue to be more job openings than unemployed persons, but the number is slowly tightening. There have been announcements of layoffs at several large companies that hired extensively following the pandemic. In a normal recession, job losses mount and the unemployment rate increases. While the unemployment rate may increase in this potential recession, it may not rise as dramatically since many mid- and small- businesses never reached full employment following the pandemic. The labor market mix has changed. The baby boomers are retiring, and new job entrants are not as great as in past recessionary periods. If we have a recession, it does not appear that it will be a deep and long recession like the Great Financial Crisis in 2007-2009. Consumer and business balance sheets are in decent shape, many of the market excesses have been washed out this year, and the supply chain issues that are still working themselves out will help balance the excess usually experienced in recessionary periods.

Looking into 2023, what are the risks and what should investors expect?

As a long-term investor, there are always risks that will impact markets year to year. The negative returns experienced in 2022 were dramatic and painful. Until this past year, there had not been a true bear market in stocks since March 2009. Fixed income never had a bear market like this past year. Typically, equity bear markets last 18 to 24 months but can be shorter or longer. Looking at where we are in the market cycle, equity markets could continue to experience volatility and potential negative returns over the near term, but market timing is exceedingly difficult to achieve. As a long-term investor, the opportunities in both fixed income and equities are greater today than a year ago. Investing in the appropriate allocation for individual risk tolerance, staying the course, and remaining invested will benefit investors despite the short-term risks.

It is extremely important for investors to take a step back during these volatile times and remind themselves of their long-term goals. Investing in an appropriate investment allocation is the long-term driver of returns, and a diversified portfolio of bonds, stocks, and alternatives is appropriate.